The next time you are in your car, take a look at the street signs and lamp posts you pass. A large number of them will have a mute, silver colour on them. That “silver” is actually a zinc coating.

Galvanizing is one of the most widely used methods for protecting metal form corrosion. In other words, zinc is everywhere, but is so often overlooked. But not anymore.

After years of limited investment in new production, in 2018, zinc managed to catch the market off-guard and leave users scrambling.

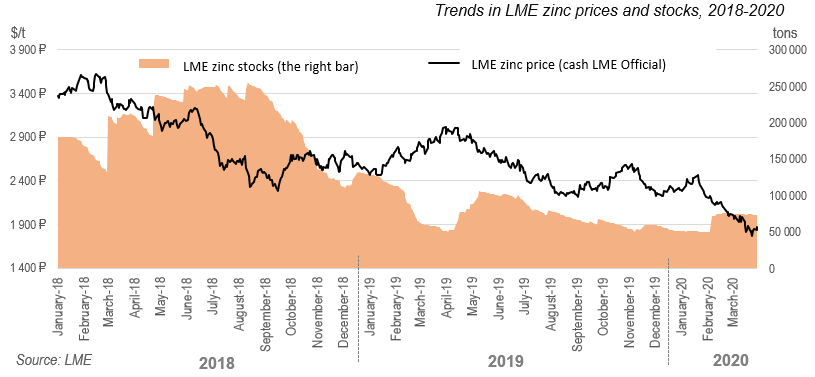

Prices peaked in May 2018 at over $3,500/tonne, but has remained above the $2,200/tonne mark until a little known bug you might have heard of sent the market into a freefall scenario. In May this year, prices hit a trough of just under $1,900/tonne.

Zinc on the precipice of a market rebound

Zinc has to be one of the most uninspiring metals. Ubiquitous of course, but for decades the price went nowhere. Then boom! From 2018, the zinc price rallied for 18 consecutive months, catching everyone off-guard, climbing over 40% and suddenly consumers were left scrambling and simply could not seem to get enough.

While the impact of COVID19 has muted prices somewhat, as prices are still relatively high on a historic basis, it is important to ask why this rally occurred and more importantly, will zinc prices rise to these levels again?

A look at the why

The fortunes of the zinc market really started to change in late 2015 when Glencore revealed its intention to cut 500,000 tonnes of zinc concentrate production, pushing the market into deficit. At this time, there were still plenty inventories around, so prices did not improve just yet.

However, at the same time that all this was going on with Glencore, zinc was still needed to sustain high growth markets.

Roughly 60% of all zinc use is in construction for galvanised steel with demand rising around 2-4% per annum (approximately 280,000-560,000 tonnes per year) driven by global recoveries in GDP growth and continued urbanisation and infrastructure development.

Chart 3: End user markets for zinc

[visualizer id=”11765″]

Source 9: USGS

In short, over 1.5 million tonnes of material was taken out of the market resulting in a deficit market until 2019.

The COVID effect

In the first quarter of the year, the average LME price for zinc had fallen 21% to $2,128/tonne compared to the same period in 2019. However, it is positive to see the price having remained above the 2,000-dollar mark.

In the first two months of the year, zinc concentrate output had contracted by 12% y.oy. in China to 517,000 tonnes while LME zinc stocks fell profoundly to below 50,000 tonnes. Closures of key operations in Bolivia, India, Peru and Mexico, coupled with pre-existing environmental pressures on China is expected to continue to place pressure on zinc supplies. Meanwhile infrastructure projects are well underway in China, which is at pains to ensure an economic recovery, calling for a sharp recovery in zinc consumption.

There is no doubt that as economies begin to recover from COVID and re-open, mining restarts will alleviate some of the supply deficits and place downward pressure on prices. However, we see that the restarts will happen in increments and in different parts of the world and efforts to lift containment measures will be relatively slow for the next year, which is expected to continue to support zinc prices at around $2,000-2,150/ton.

Our long term view over the next five years is that zinc prices will hold at around the $2,400-2,600/ton level, which while below the high of over 3,000 dollars, is a good level to ensure the closures of inefficient producers and allow for a more balanced market, while generating decent investment returns.

[visualizer id=”11769″]

How to gain exposure?

Unlike gold, there’s no zinc ETF. No one is about to sell you zinc bullion. So, the main options for a serious investor to get exposure to this current bull run is through investing in companies with access to quality zinc deposits. We consider the following five opportunities below:

Callinex Mines (TSX.V: CNX) (OTX: CLLXF): Based in the Canadian Bathurst Mining District, one of the largest volcanogenic massive sulphide (VMS) sites in the world, the company is focused on developing the Nash Creek and Superjack Projects. The company’s PEA was completed in 2018 and outlines a 10-year 3900tpd operation with Indicated resource containing 963 million pounds of Zn Eq. contained within 13.6Mt grading 3.2% Zn Eq. and an Inferred resource containing 407 million pounds of Zn Eq. contained within 5.9Mt grading 3.1% Zn Eq.

Ivanhoe Mines (TSX: IVN): Ivanhoe is a Canadian Mining company focused on developing projects across Africa. The company’s major zinc project is the Kipushi polymetallic deposit which hosts zinc, copper, germanium and silver located in the DRC. In addition to Kipushi, Ivanhoe owns some of the largest copper and PGM projects in Africa, including the Kamoa-Kakula copper deposit in the DRC and the Platreef PGM deposit in South Africa’s Bushveld Complex.

Lundin Mining (TSX: LUN): Headquartered in Toronto, Lundin Mining operates in five jurisdictions, US, Sweden, Portugal, Brazil and Chile. The company’s zinc operations are based in Europe with Zingruvan in Sweden and Neves Corvo mine in Portugal. In addition to zinc, the company focuses on other base metals including copper and nickel, and is therefore well-placed to take advantage of a turn-around in the global economy which is expected to be driven by fiscal spending and wide-scale infrastructure development programs.

Trilogy Metals (TSX: TMQ): Trilogy Metals is a mining company with projects in Alaska. The company is focused on developing deposits in the Ambler districts which are known for having vast mineralization endowments particularly in zinc, lead, silver, gold and cobalt. The company is on track to complete its feasibility study in the 3rd quarter, 2020 for its Arctic deposit. Pre-feasibility estimation show contained copper equivalent of 4,102million pounds and 43Mt@2.3% Cu|3.2% Zn|0.59% Pb |0.49g/tAu |36g/t Ag

Orion Minerals (ASX: ORN| JSE: ORN): Orion owns the Prieska zinc-copper deposit in South Africa’s Northern Cape Province. Prieska is a brownfield deposit, mined from the 1970’s until the 1990’s. Like Callinex, it is considered one of the world’s top 30 volcanogenic massive sulphide (VMS) base metal deposits with a record historical production of over 1Mt of zinc and 430,000 tonnes of copper from 46.8Mt of sulphide ore.