In the last two years, tin prices have risen from under $15,000/ton in February 2020 to $45,000/ton today with no sign of going down. However, despite this, tin has not yet attracted that many new entrants. There remainsrelatively few listed tin players, with the majority coming from Asia. For instance, Yunnan Tin Company (SZSE: 000960), which produces around 74,800 tons of metal trades on the Shenzhen Stock Exchange and PT Timah (IDX:TINS) is owned by the Indonesian government and produces around 45,800 tons of tin a year. Outside of Asia, Alphamin Resources (TSX.V: AFM) has transformed itself from a junior miner, laden with debt, to a cash generative company with a billion-dollar market cap over this time. The company now accounts for 4% of the globe’s tin output and has finally put the DRC on the map for positive reasons.

Tin prices hitting new highs

Tin is considered one of the metals important for future technologies or “MIFTs”. The metal is heavily used in electronics and has long term demand prospects in the use of electric vehicles and 5G mobile communications.

After years of limited investment in new production and declining inventories for nearly two decades, tin caught the market off guard in 2020 and users were left scrambling.

Tin prices are hitting multi-year highs and the smart money is not about to let this opportunity slide.

Key to the tin game: Quality deposits

Unlike gold, there’s no tin ETF (Exchange Traded Fund). No one is about to sell you tin bullion. Theoretically it may be possible to buy the metal in bars or bullion, but it’s simply not practical. Its relatively low price per pound (compared to gold and other precious metals) means that any substantial investment will come at a very costly storage expense. One can deal in futures contracts on the London Metal Exchange, the Indonesian Tin Exchange or the Kuala Lumpur Tin Market, but for mere mortals, getting exposure to the current tin bull run is not simple.

The main opportunities for investors to invest in the metal is through investing in companies with access to quality tin deposits.

Cue in TSX-V listed Alphamin Resources (TSX.V: AFM). As a producer of 4% of the world’s mined tin from their high-grade operation in Africa, the company has already benefitted from the fortunes of the tin market from its Mpama North project and continues to reinvest its profits to expand its mine to the South.

A busy end to quarter 1

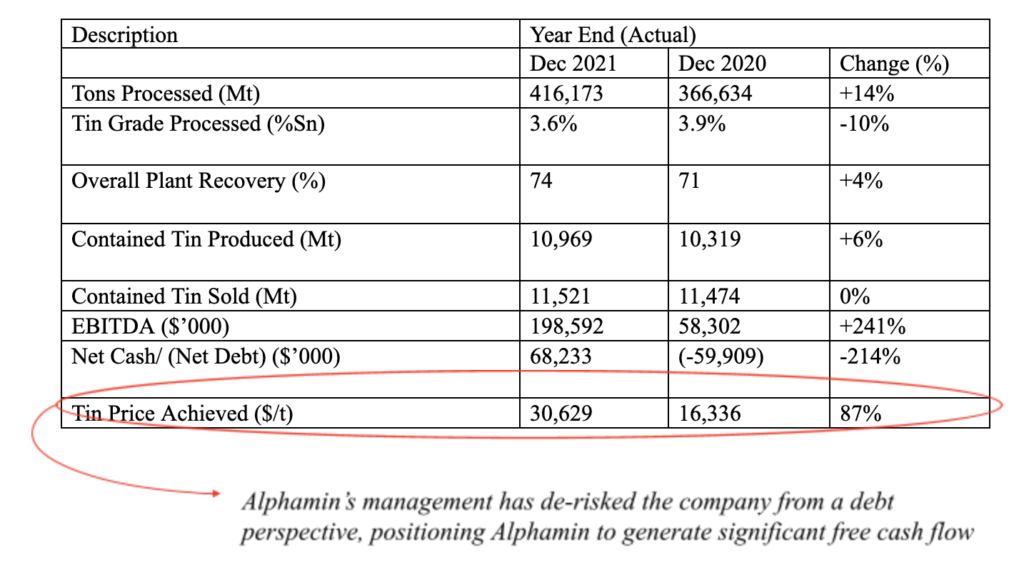

On the 7th of March, Alphamin released its end of the year and fourth quarter results. The results ticked several key metrics:

✓ Production – up 10% q.o.q to 3,114 tons

✓ Tin sales – up 14% q.o.q to 3,056 tons

✓ Net Cash – up to $68m from $1m in the previous quarter!

✓ Maiden dividend declared and paid of C$0.03/share

✓ Record EBITDA of $74m, up 38% q.o.q

The fact that the Company’s share price only moved up by around C$0.02/share on their end of year results, can only suggest that investors have not quite grasped just how incredible these results actually were.

Alphamin continues to improve its underground mining practices in order to optimize the average tin grade that they are able to process. During the five months ended in December 2021, the average tin grade was 3.8%. To put this into perspective, investors would start to get excited over a tin mine with average grades of 1%, so Alphamin touching 4% is phenomenal.

The Company continues to push production, taking advantage of the favourable tin price which is sitting at around $48,000/ton. Total tin production and sales rose by 10% and 13% q.o.q respectively in 4Q 2022.

The company has guided that planned production and tin sales will be 12,000 tons for the year ending 2022. If the tin price holds at around $40,000/ton, this translates to future revenue of roughly $480 million. This is conservative as we suspect the tin price will not only hold but could trend even higher (see Can tin hit 50k?). There are simply not too many junior companies on Canada’s Venture Exchange that are generating this kind of cash flow!

Alphamin continues to improve its underground mining practices in order to optimize the average tin grade that they are able to process. During the five months ended in December 2021, the average tin grade was 3.8%. To put this into perspective, investors would start to get excited over a tin mine with average grades of 1%, so Alphamin touching 4% is phenomenal.

The Company continues to push production, taking advantage of the favourable tin price which is sitting at around $48,000/ton. Total tin production and sales rose by 10% and 13% q.o.q respectively in 4Q 2022.

Alphamin management has guided that planned production and tin sales will be 12,000 tons for the year ending 2022. If the tin price holds at around $40,000/ton, this translates to future revenue of roughly $480 million. This is conservative as we suspect the tin price will not only hold but could trend even higher (see Can tin hit 50k?). There are simply not too many junior companies on Canada’s Venture Exchange that are generating this kind of cash flow!

Alphamin Resources (TSX.V : AFM) confirms positive Preliminary Economic Assessment (PEA) for its Mpama South project

To date, Alphamin has been producing predominantly from its Mpama North operation. During March 2022, the Company declared its maiden Mineral Resource on Mpama South, making it the second highest grade publicly reported tin Mineral Resource globally and one of the largest in terms of contained tin with: –

- 0.83Mt @2.58% Sn for 21.5kt contained in the indicated category; and

- 1.95Mt @2.52% Sn for 49.1kt contained tin in the inferred category

The Company also reported a positive PEA result for Mpama South with annual estimated contained tin production of 7,332 tons. All in sustainable costs (AISC) are estimated at $15,188/t against a tin price of $40,000/t. This leaves an extremely healthy margin of around $24,812/t!

The PEA also estimated EBITDA and capital development costs of $187M and $116M respectively, providing a short payback period. Moreover, the development infrastructure will be able to leverage the infrastructure from the currently producing Mpama North mine as the North and South Mpama projects eventually meet up to become one large deposit (Figure 1). This not only speeds up the construction timeline considerably but also reduces the capital costs and outlay.

Figure 1: Mpama South and Mpama North becoming one deposit (View from East)

* The outputs are basis 100% of the project. Alphamin indirectly owns 84,14% of the project.

It is expected that the Mpama South Project will increase Alphamin’s annual tin production from 12,000tpa to 20,000tpa, which is 6.6% of the world’s tin output.

Maiden Mineral Resource for Mpama South Published-2nd Highest Grade in the World!

March 2022 the Alphamin Resources (TSX.V: AFM) had three mega wins:

- Great year-end results

- A positive PEA

- A maiden mineral resource for the Mpama South Project.

To estimate the maiden mineral resource, 102 drill holes were analysed over 23,103m.

The maiden mineral resource declared on Mpama South is the second highest publicly reported tin resource in the world by grade. In particular, the results show:

- 0.85Mt @ 2.55% Sn for 21.5kt contained tin in the Indicated category; and

- 3.42Mt @ 2.45% Sn for 83.7kt contained tin in the Inferred category

There is also further upside potential for the Mpama South Resource as the results did not include subsequent drilling that was completed in September 2021, and which showed positive results with high grade ore. Over 30 subsequent drillholes over 10,000 meters were excluded from these results.

To understand how truly well-endowed Alphamin’s Mpama North and South tin projects are, one needs to consider it against its peers, where the weighted average tin grade is only around 0.39%!

| Deposit | Country | Company | Ore (Mt) | Sn (%) | Sn (t) |

| Syrymbet | Kazakhstan | Syrymbet JSC | 94.5 | 0.49% | 463,050 |

| Mpama North** | DRC | Alphamin Resources | 4.8 | 4.063% | 194,200 |

| Cinovec | Czech Republic | European Metals | 79.7 | 0.23% | 183,310 |

| Achmach | Morocco | Kasbah Resources | 14.6 | 0.9% | 131,400 |

| Gottesurg | Germany | Tin International | 42.1 | 0.267% | 112,407 |

| Pravourmiskoe | Russia | LLC Pravoumiyskoe | 10.5 | 1.008% | 106,046 |

| Hamerlein-Tellerhauser | Germany | Anglo Saxony Mining | 22.1 | 0.46% | 101,660 |

| Rentails | Australia | Metals X | 21.8 | 0.45% | 98,289 |

| Heemskirk | Australia | Stellar Resources | 8.5 | 0.969% | 82,365 |

| B2 | Peru | Minsur | 7.6 | 1.05% | 79,937 |

| Oropesa | Spain | Eurotin | 12.5 | 0.553% | 69,100 |

| East Kemptville | Canada | Avalon Advanced Materials | 35.4 | 0.163% | 57,586 |

| Taronga | Australia | Aus Tin Mining | 36.3 | 0.158% | 57,224 |

| Mt Pleasant | Canada | Adex Mining | 15.2 | 0.27% | 55,600 |

| Ardlethan | Australia | Australian Tn Resources | 35.1 | 0.155% | 54,505 |

| Total | 455 | 0.393% | 1,790,833 |

** Excludes Mpama South

Source 2: ITRI

Alphamin Resources – well positioned as a potential 2022 breakout stock

In 2021, four companies broke out to become the darlings of the equity world, returning significant profits to investors.

Given the positive metrics of Alphamin Resources. (TSX.V: AFM), when taken against the positive market fundamentals for tin, it is foreseeable that the company could take its place amongst them.

The bottom line on gaining exposure to the tin rally

There are strong fundamentals supporting a continued tin market rally. Prices have already reached multi-year highs, but given reduced inventories and demand from new technologies, there is certainly room for further growth in this market.

Alphamin Resources (TSX.V: AFM) is a junior mining company, leveraged to take full advantage of the tin market rally. From a grade perspective, Alphamin’s peers are found wanting. Furthermore, the company has de-leveraged its balance sheet, removing a lot of the financial risk. They are in production and, at a tin price of above $40,000/t, are highly cash generative. Alphamin was even able to pay a maiden dividend, how many junior miners can do that?

Perhaps, most importantly, is that Alphamin Resources still has legs for those not yet invested. Management has mapped out a clear, near-term growth path. Its pursuit of the Mpama South Project, while continuing to produce from its northern counterpart, will raise the company’s output from 12,000 to 20,000 tons per year, accounting for over 6% of the globe’s tin output. Moreover, the ability to leverage the infrastructure from its current project significantly reduces the capital outlay to commission Mpama South and speeds up the overall payback period.