On the 23rd of October 2017, Core Consultants presented a paper at the Annual Nickel Institute Conference (INSG) which summarized the current state of the Lithium Ion Battery Market. You can download the full presentation with audio here.

The Lithium Ion Battery market is undergoing a revival with billions having been committed over the last two years and billions more to be committed over the next five years in order to expand production capacity. We are witnessing the birth of the multi-gigawatt hour production facilities, which we estimate will increase demand for lithium-ion storage by over 100GW by 2021.

Tesla has become a household name; it is not a traditional battery manufacturer, yet has chosen to develop a gigafactory in Nevada, the largest of all new lithium-ion battery plants. This decision has arguably disrupted two mature industries, causing the automotive giants, such as General Motors and Nissan Motor Co, Ltd, to re-evaluate their positions with respect to developing electric vehicles, while also disrupting the battery manufacturers, forcing them to consider their expansion plans and increase their scale.

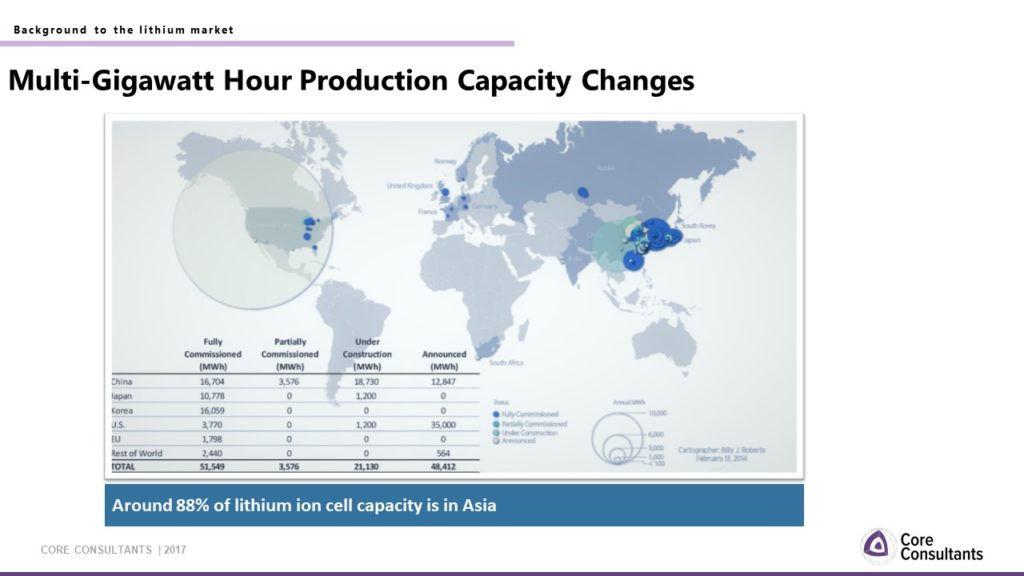

Tesla aside, the majority of new lithium-ion battery capacity is actually being developed in Asia. At present around 88% of all lithium-ion cell capacity is here, and Asia is expected to retain its monopoly.

The graph shows current projects, projects under construction, which are expected to be commissioned by the end of 2018, and then announced projects which are expected to come online by the end of 2021.

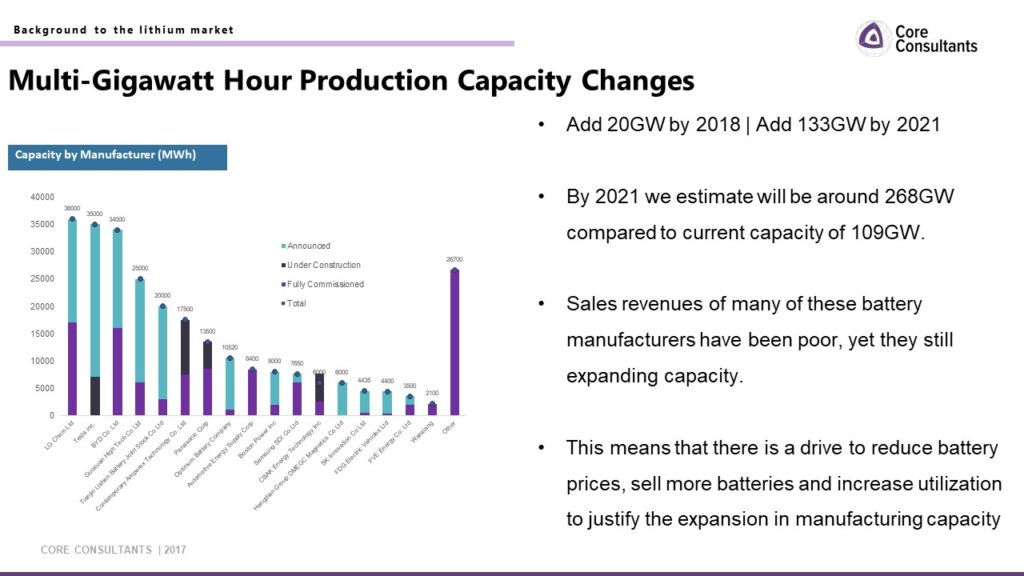

Leading the expansion in China, BYD is expecting to expand its capacity to 34,000 MW from the current 16,000 MW. Other significant expansions include Guoxuan High Tech which will produce 25,000 from the current 6,000 MW capacity; Lishen is set to increase its capacity by 17,000 MW bringing its total to 20,000 MW, and Amperex is expected to raise its capacity by 10,000 MW to 17,500 MW.

Samsung is also looking to expand its capacity in China and is already well established in South Korea. LG Chem has announced an expansion of 19,000 MW and is expanding its Holland Michigan cell plant to 36,000 MW over the next four years.

US-based Boston Power is also focused on increasing its capacity in Asia including China and Taiwan.

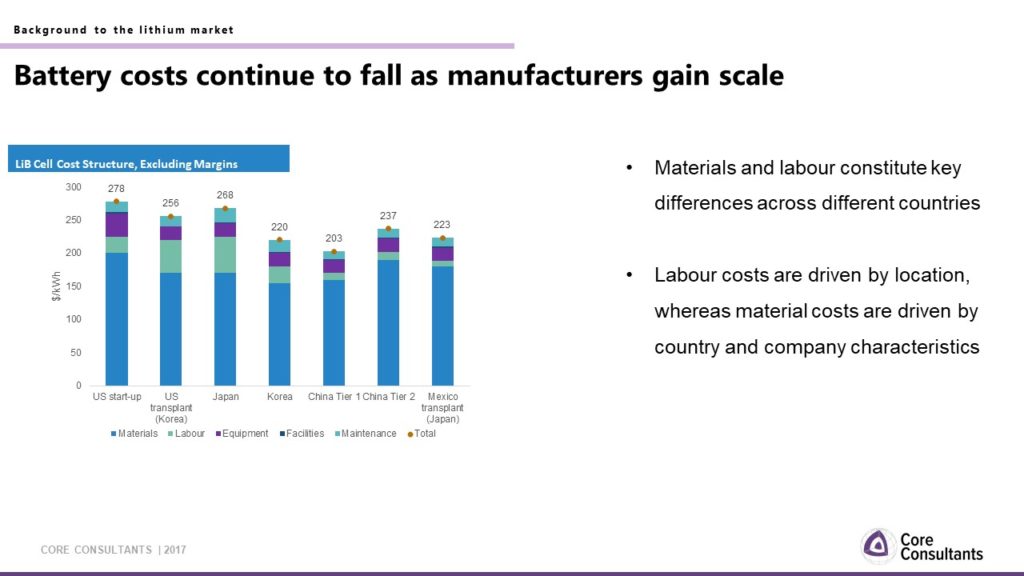

It makes sense that the capacity should remain in Asia when we consider the cost differentials between China, Korea and the US shown above.

Despite battery manufacturer’s sales volumes being quite poor they have chosen to continue the expansion. This means that there is a major drive to reduce battery prices, sell more batteries and increase utilization in order to justify the capital expenditure.

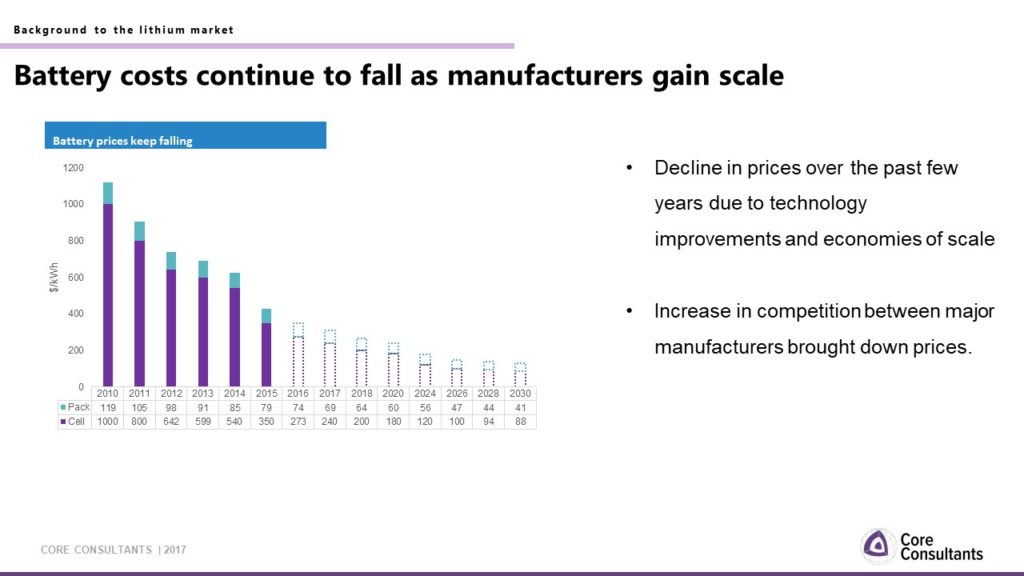

The cost of producing a lithium cell has fallen from $1000/KwH in 2010 to around $240/kWh in 2017, and Bloomberg New Energy Finance’s team calculates the production costs of Korean plants is around $162/kWh in 2017. The expectation is that this cost will continue to decline, and we estimate that prices of cells will average $88/kWh by 2030.

The cost of batteries is the main reason why passenger EV’s are more expensive that Internal combustion engine vehicles today, and the question often arises as to whether lithium cathodes may be replaced in the near term.

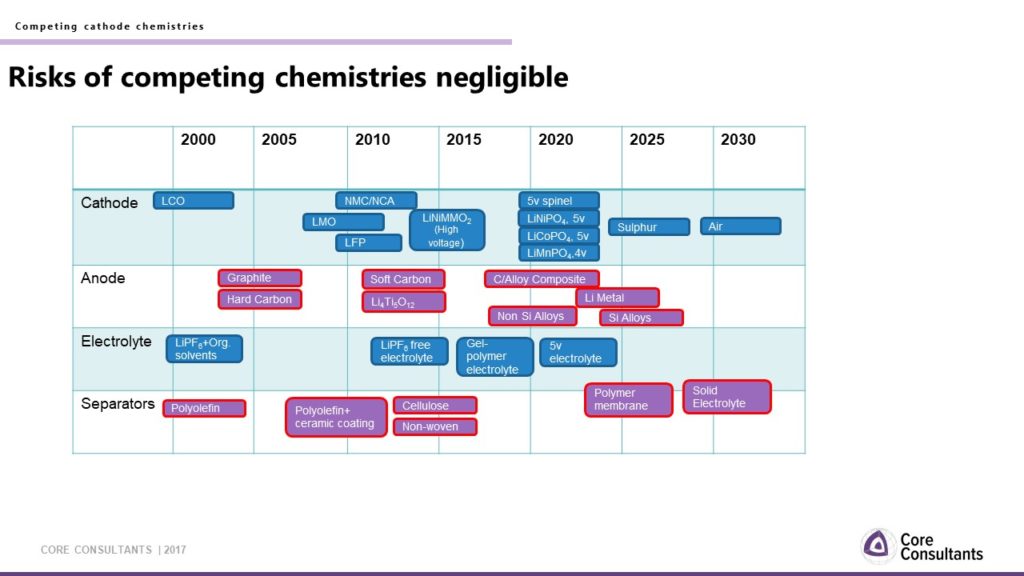

We would say that the risk of this is negligible for three main reasons:

- Lithium batteries are a known and proven technology. Sony first used the lithium-ion battery in the Sony Walkman in the 1990’s. The fact that the public already uses lithium-ion batteries in portable devices means that the technology has already gained public acceptance. They are comfortable with it.

- Commercialisation of a new energy storage solution takes a long time. New battery technologies such as the lithium Sulphur and the lithium air battery are only expected to be commercialised in 2025 or 2030; the road is long. The first lithium-ion rechargeable battery was invented in the 1970s but it was only commercialized by Sony in the 1990’s, and then only really gained traction when smartphones took off after around a decade ago.

- Lithium batteries are getting better and better: Aside from the costs which are consistently coming down, there has been a lot of investment into R&D for these batteries and we are seeing tangible efficiencies from a life-cycle perspective. Improvements in energy density have increased it by around 5% every year since 1992.

There is the expectation that new cathode chemistries will come to the fore. The most promising technologies being the lithium sulphur and lithium-air batteries, though battery manufacturers are not expecting these to become commercialised before 2025 and 2030 respectively. Which is another indication that the road to commercialisation is a long one.

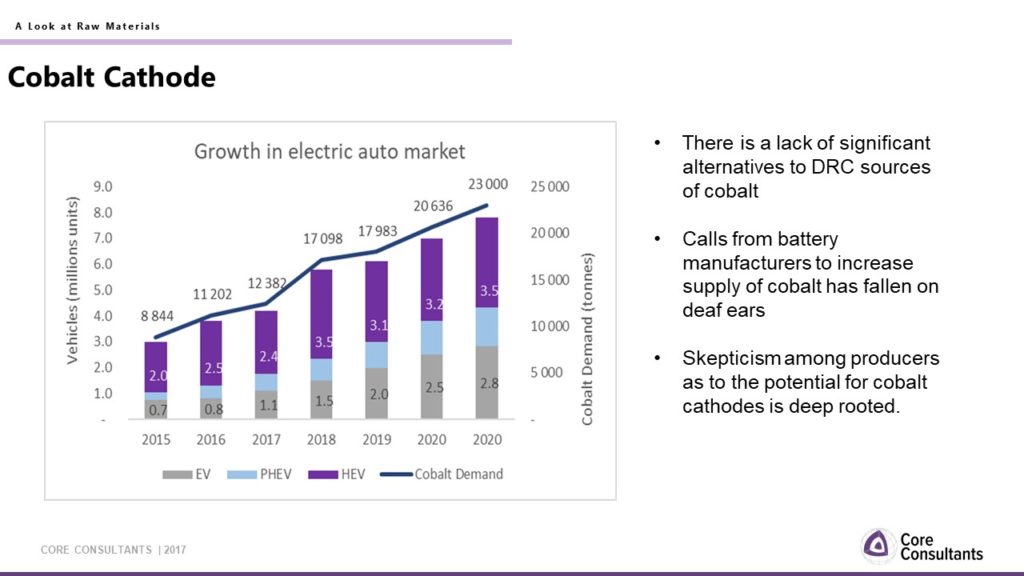

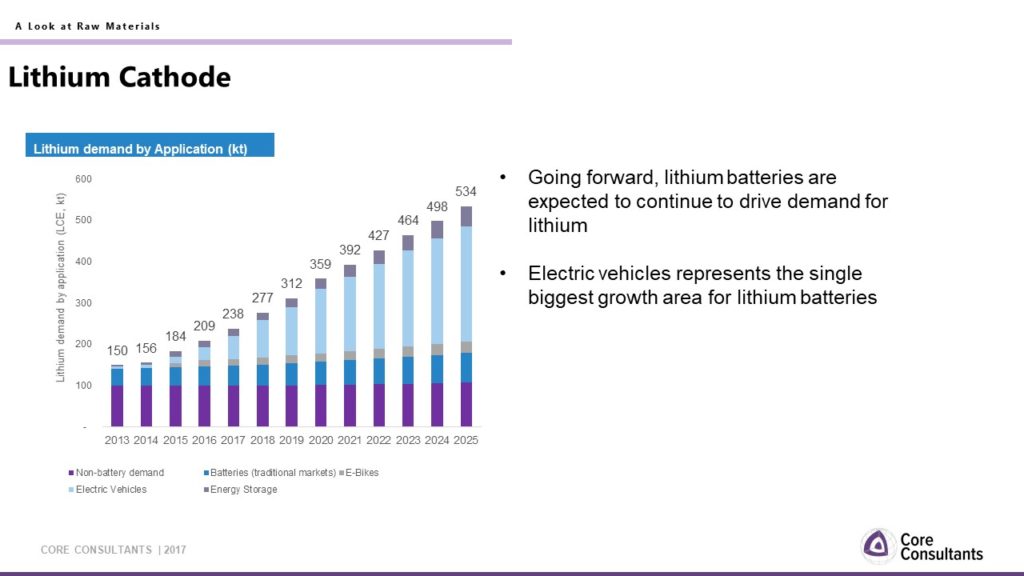

The electrification of vehicles is arguably behind this expectation of increased growth in lithium battery demand.

Adoption of these cells in the automotive sector is seen as the holy grail for lithium batteries. It is the reason why there has been such a focus on costs, as having a high-cost battery in a smartphone is not such a big deal, but when one scales this up to a vehicle, it becomes untenable.

The fact that target costs are now in sight and are looking achievable, forecasts from all battery and auto manufacturers are centered around lithium-ion batteries being the storage solution of choice for electric vehicles.

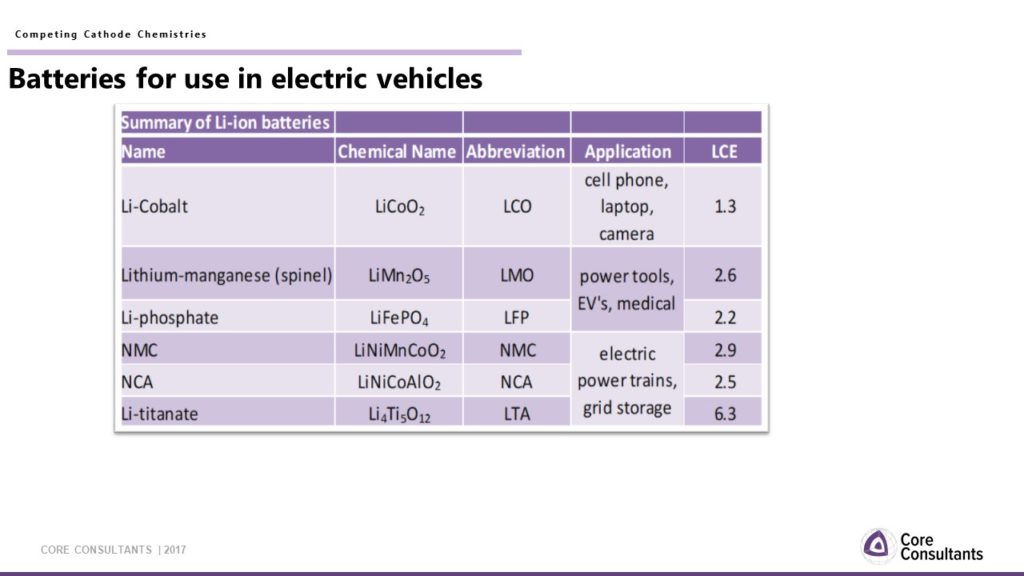

Currently there are six main cathode chemistries being explored, four of which are showing more promise for use in automobiles.

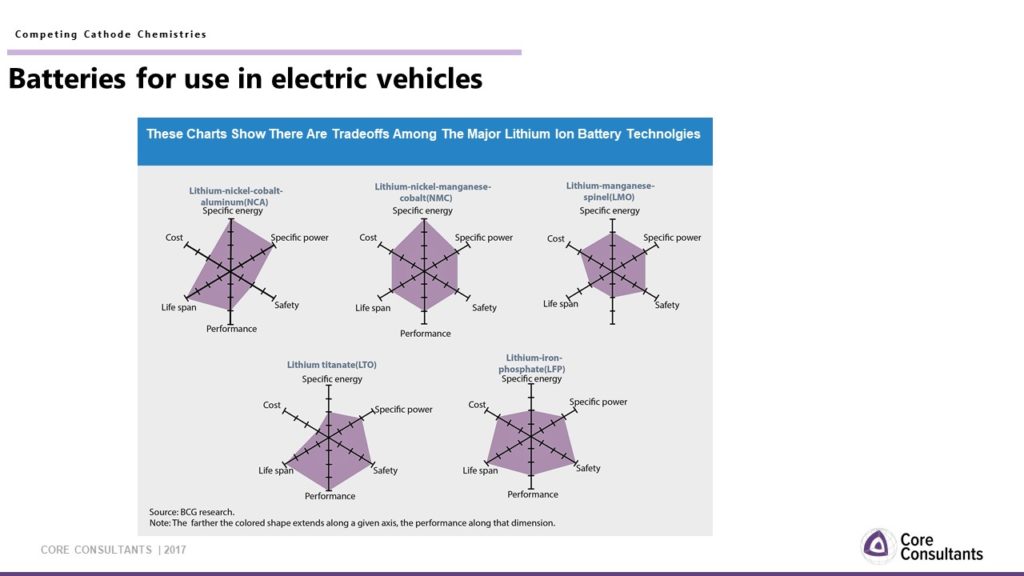

The decision to adopt one battery technology over another is not trivial, as in each instance, there are significant tradeoffs that must be factored in when forecasting the potential market share of each battery going forward.

The major criteria for an automotive battery:

Safety. We have seen global recalls of various automobiles. In the case of electric vehicles, as this technology is relatively new, even a single fire could turn public opinion against electric mobility and set back industry development for months or even years. The main concern is avoiding thermal runaway which is defined as a positive feedback loop whereby chemical reactions triggered in the cell exacerbate heat release, potentially resulting in a fire. The chemistries that are prone to this include NCA, NMC and LMO batteries.

Lifespan. There are two ways of measuring this: cycle stability and overall age. Cycle stability is the number of times a battery may be fully charged and fully discharged before being degraded to 80% of its original capacity at full charge. Overall age is the number of years a battery can remain useful. Today it is the overall age that remains a hurdle as with lithium batteries, exposure to high temperatures accelerates degradation.

Performance. The owner of a vehicle reasonably expects that he or she should be able to drive his or her car safely in both hot summers and freezing winters. To date, batteries can be optimized for either high or low temperatures, but it is challenging to engineer them to function over a wide range of temperatures. For example, performance during cold climates would rely on heating insulation, whereas those designed for hot climates would use electrolytes and materials that allow for high-temperature storage. The difference between these two battery designs is more substantial than the current distinction between for example hot and cold weather tyres.

Specific energy and specific power. The specific energy of a battery is their capacity for storing energy per kg of weight. Currently, the driving range is limited to around 250-300km for an electric vehicle between charges which is not long enough for driving long distances. Also, currently it takes around 30 minutes to charge a battery to 80% capacity, so to charge this every 300km is less than ideal. Battery cells today reach nominal energy densities of around 140-170Wh/kg compared to 13,000 Wh/kg for gasoline. The specific energy of the resulting battery back is typically 30-40% lower, or 80-120Wh/Kg.

Specific power, the amount of power that batteries can deliver per kg of mass, is pretty good with current technologies. This is needed more in hybrid vehicles that discharge a small amount of energy quickly. In electric vehicles, specific energy is more important than power, and manufacturers have established design parameters for electric vehicle batteries to optimise this trade-off between specific energy and specific power.

In each instance, there are tradeoffs in the properties of the major lithium-ion battery technologies. The NMC battery appears to be the most balanced from a safety and specific energy perspective.

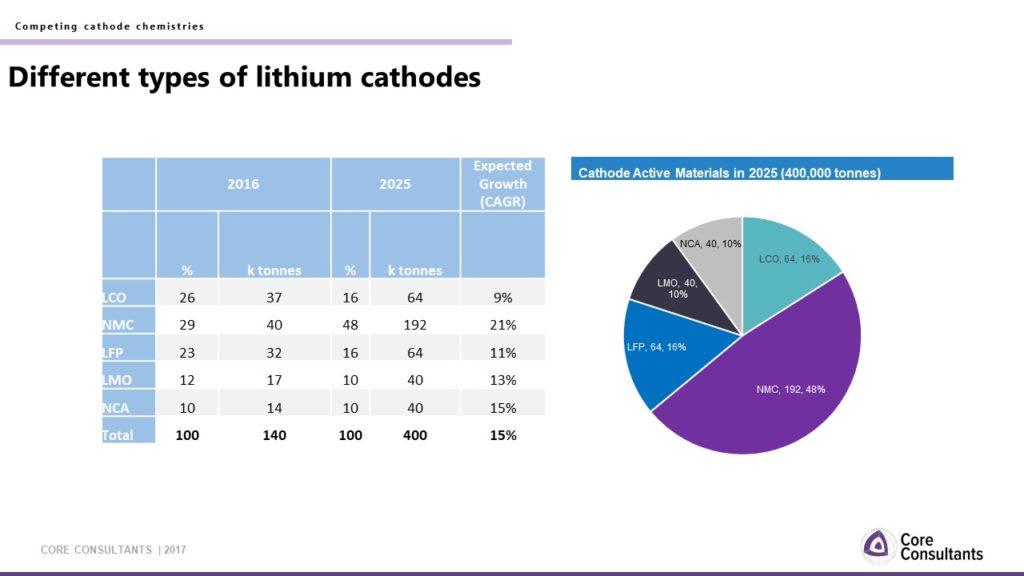

In terms of cathodes, the NMC battery accounts for just under a third of the cathode market by volume and is expected to be a mainstay in the industry. As the vehicle market starts to overtake the portable electronics market with respect to lithium demand, the NMC battery is expected to be a beneficiary at the expense of other technologies.

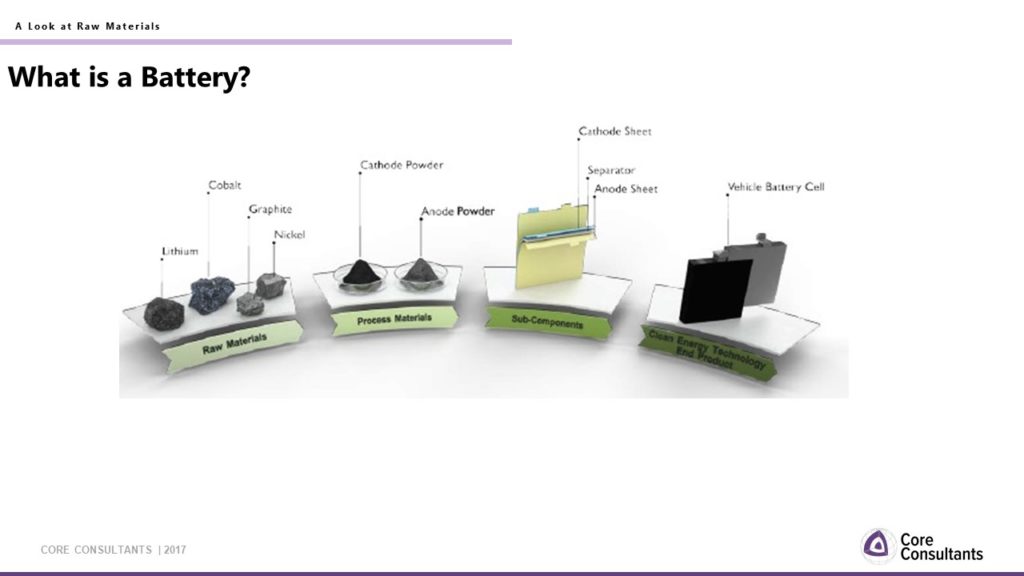

A battery consists of a cathode, anode and a separator. These three components consume a wide variety of metals. The most intensive anode component is graphite, while the cathode is a blend of metals based on lithium including lithium carbonate. Cobalt is used as the additive in mainstream lithium-ion cathodes and is critical as it acts as the binder for the lithium ions and allows the ions to move through the cathode to the anode during discharge.

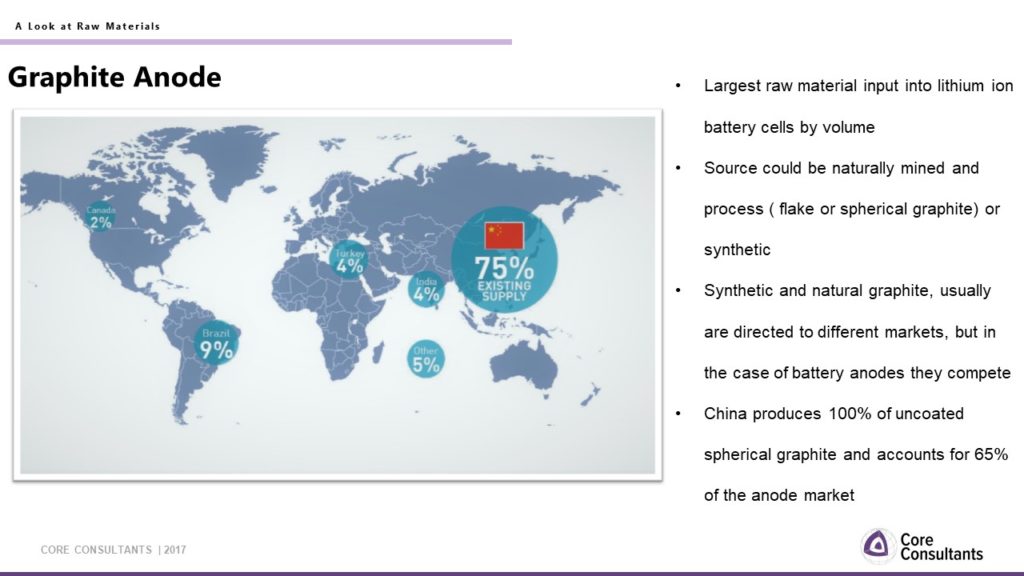

Graphite is the largest raw material input into lithium-ion battery cells by volume and comprises the majority of the anode. The source of graphite could be naturally mined and processed (flake graphite/spherical graphite) or synthetic graphite. In general, the way that graphite is produced varies; it is sold into different markets and fetches different prices. However, in the anode market, these two camps compete for the same piece of the action.

At present, China produces 100% of uncoated spherical graphite and accounts for 75% of the anode market. The main reason for this is that Chia is the lowest cost source of flake graphite feedstock. The ability to compete with China on cost is what constrains diversification in the graphite market. However, there is concern that as China increases its environmental stringency, this could create room for other players.

Synthetic graphite is produced using pet. coke or tar, which are by-products of the oil and coking coal industry respectively. This graphite is typically used in the steel industry and is highly energy intensive. In order to ensure battery grade material, the higher quality carbon raw materials are specifically chosen, formed into blocks and baked at 700-900C. Once this is achieved the stock is then graphitized by temperatures of up to 3,200 C to achieve a specific shape and density. The product is sold for between $10,000 and $16,000/tonne, more than double the cost of coated anode spherical graphite material, which retails at around $7,000/tonne. Major producers of synthetic graphite are the US, Japan and China.

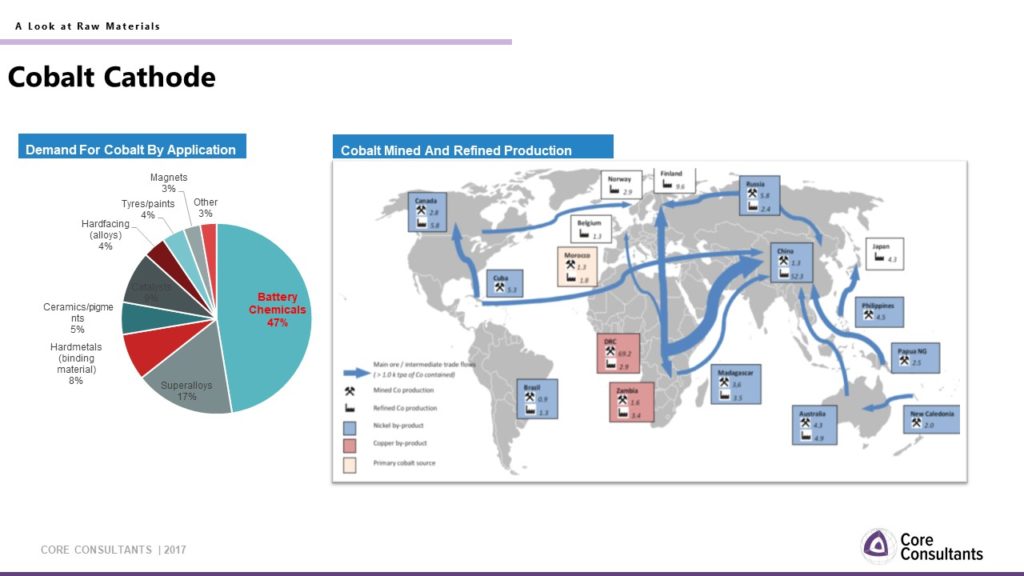

Battery demand has become the single largest use for cobalt. The limiting factor with cobalt is that it is produced as a by-product of either nickel or copper and there are no significant production hubs outside of the DRC.

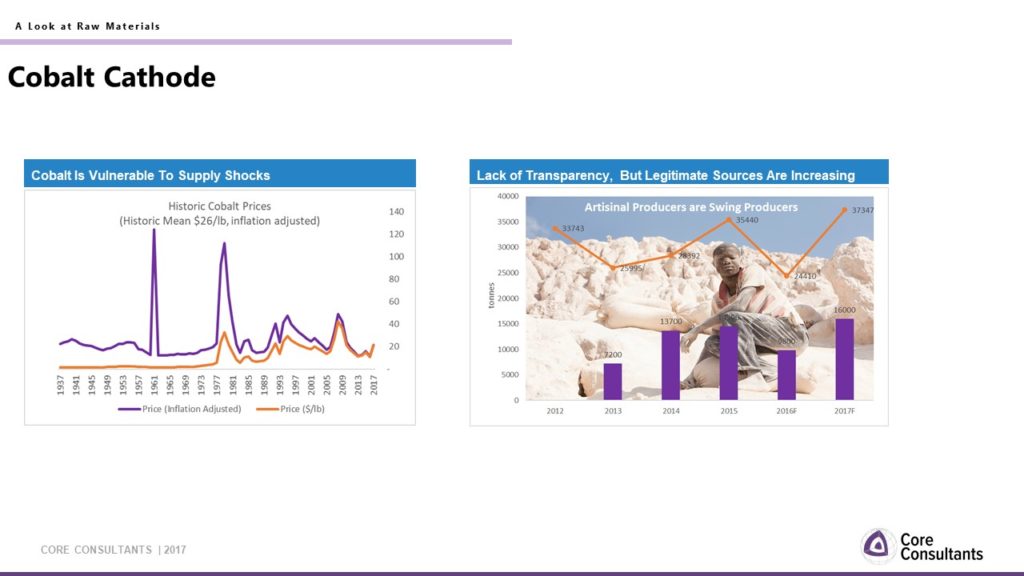

As such, cobalt is vulnerable to supply insecurity. This was seen in 2008 when cobalt prices increased from $11/lb to 52/lb on the back of country instability.

The other major issue is the lack of transparency in the cobalt supply chain. DRC output in 2016 was around 69,200 tonnes or 65% of cobalt mine supply. We have written multiple times on the cobalt supply chain.

Officially in 2015, the DRC government estimated that 13,700 tonnes of cobalt was produced by artisanal miners, but we believe that this figure was higher because, in addition to the volumes acquired and exported by companies such as CDM, substantial volumes have been stockpiled.

We do note that legitimate cobalt as a proportion of total production is increasing.

More stringent global consumer and producer legislation, grade depletion, as well as the fact that the more accessible high-grade reserves are depleting, will likely reduce the level of artisanal mining.

The concern is that, as cobalt prices have increased, the profit margin across the artisanal chain will have increased, incentivising continued production.

There are around 100,000 artisanal miners, and seasonally this can increase to around 150,000, which we expect to be the case if prices remain at this level.

If we focus on cobalt coming from the DRC. We do note that legitimate cobalt as a proportion of the total cobalt is increasing. DRC output in 2016 was around 69,200 tonnes or 65% of cobalt mine supply.

At the same time, the announced projects that we would consider firm supply, is not substantial.

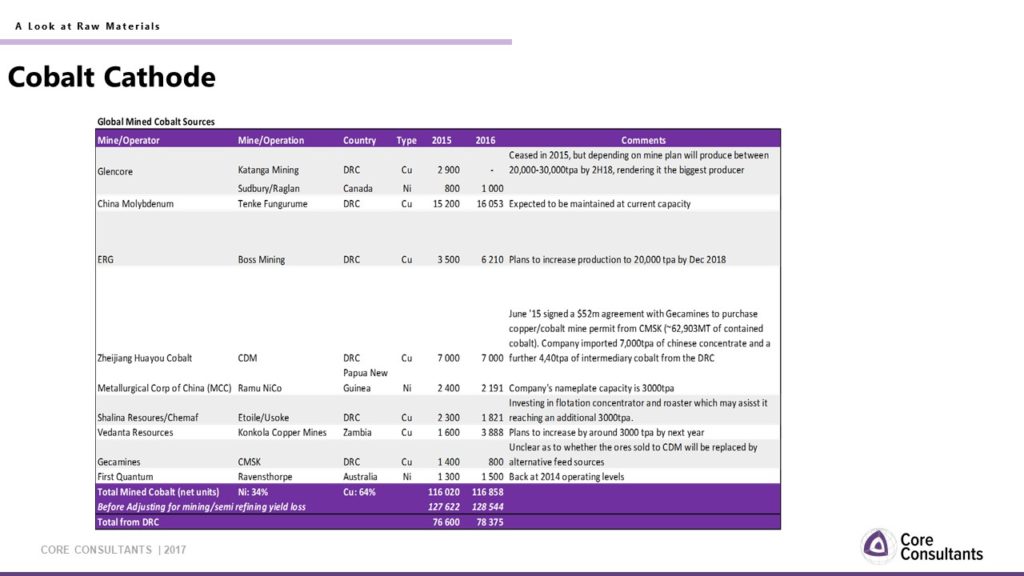

Going forward, ENRC is planning to increase capacity by 20,000 tonnes with production expected by December 2018. Katanga can bring between 20,000 and 30,000 tonnes depending on their mine plan by around June/July next year. Vedanta (KCM) can produce around 3,000 tonnes and then there’s some marginal capacity increases expected.

In total, by the end of 2018, we expect the additional capacity to be somewhere between 50,000-55,000 tonnes depending on what efficiencies can be gained by existing producers. Around 20% is lost in the refining process.

In terms of cobalt demand for auto batteries, we predict that this market will necessitate around 17% of total cobalt supply.

The lack of significant alternatives to the DRC has been a point of consternation among battery manufacturers with many considering other technologies, most recently nickel sulphate has come into the spotlight, but this is still a number of years away from full commercialization.

While there are calls from battery manufacturers to increase the supply of cobalt, skepticism among cobalt suppliers is deep-rooted and the industry is relatively conservative as the battery sector, which is not the traditional sector for cobalt, is seen as an evolving market with a number of potential battery chemistries, some of which do not use cobalt in their cathodes.

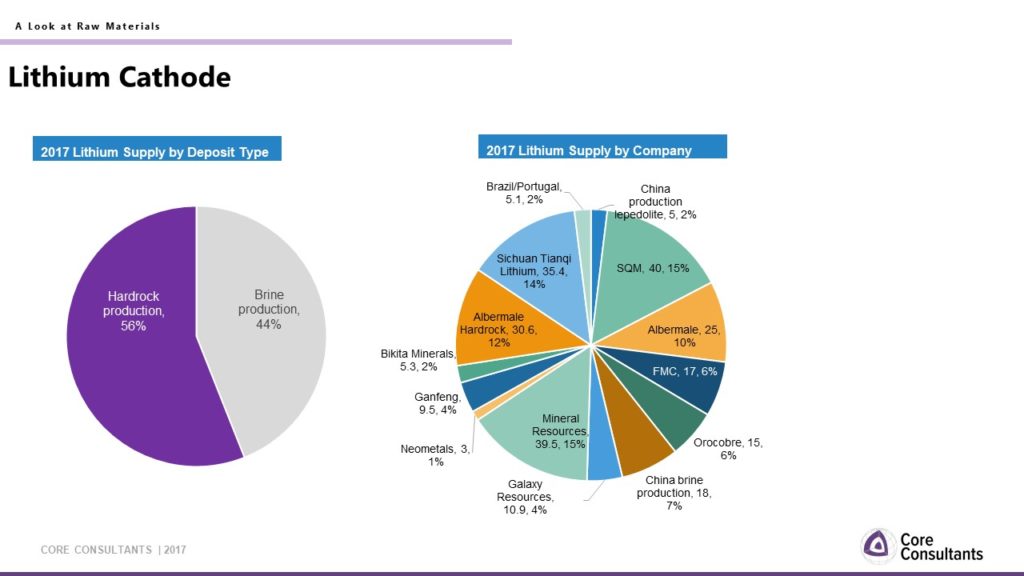

Lithium is extracted from two sources, brine and hard rock. Brine is found predominantly in South America, with 50% coming from Chile and Argentina.

The majority of hard rock lithium is mined from one large mine in Australia, Talison lithium, which produced 65,000 tonnes of lithium carbonate equivalent in 2016.

Like with cobalt, China does not have any significant commercially viable lithium reserves. There was recently an investment by BYD into the Qinghai salt lakes, but this resource, while extensive has complex geology and despite several attempts has failed to produce any significant volumes. As such, China will remain a net importer of lithium for its battery manufacturing facilities.

In 1997, SQM changed the lithium market when it commercialized the process of extracting lithium carbonate from brines. This relatively cheap source, saw the price of lithium fall by 50%, driving hard rock producers out of the game.

However, since then, lack of expansion from brine resources, has meant that the industry has again turned to hard rock potential. To this end, a number of producers have entered the lithium market, including Galaxy Resources and Neometal, which have been developing their respective resources since 2009.

Pilbara Minerals is the newcomer to the space which boasts significant resources and has tied up supply agreements

Canada has pushed exploration, especially in the Quebec region that has been very supportive of new mining juniors.

The US has been focused on the Clayton Valley in Nevada. This region used to be a leader in lithium production before the industry moved to Australia and then to South American brines.

Other promising sources include clays and there is also the potential to extract lithium from geothermal brines.

Tesla has made a play for Simbol Materials, a geothermal brine source, and Bancora Minerals in Mexico is another potential partner of Tesla. However, the automotive industry looking to invest in lithium sources is not new or unique to Tesla. Back in 2009, when I wrote my first book on the lithium market outlook, we had the likes of Honda and Toyota investing directly in acquiring lithium reserves in order to ensure its supply.

Going forward, we are at the cusp of a disruption in the traditional vehicle market. By 2040 France and UK have committed to going fully electric and it looks as if China may follow suit. It is unlikely that new cathode material, replacing lithium will be used and lithium batteries are sure to be the beneficiary of this new age of automotives.

Just to end off, let us summarise the main points of this discussion. Billions in capital has been committed to expanding global lithium battery manufacturing capabilities which should continue to reduce the unit costs.

The majority of this capacity is in Asia and due to the relative cost benefits, we expect that Asia will continue to dominate this space.

Due to the fact that lithium cathodes is a known and trusted technology, it is unlikely to be usurpled in the near term. We predict that new cathodes will be introduced by around 2025 but these will still rely on lithium

China is expected to continue to dominate the anode market, due to the relative cost advantage of natural graphite. China does rely on imports for cobalt and lithium, but dominates the cobalt space in terms of refined product

Due to the under-development in cobalt assets, cobalt seems to be the limiting factor. Furthermore, despite cries from the cathode producers, there seems to be a deep-rooted skepticsm from cobalt producers that additional supply will be needed, given the fact that not all cathodes use cobalt chemistry. Therefore we would say it is the limiting factor.

Lithium batteries are expected to continue to see demand from electric vehicles which will become the dominant end user market for lithium.

To View Presentation, Click on the link: Lithium Batteries- An Outlook and Summary