In July’s Rare Earth Report we see that the Sino/US trade war has taken a slight turn with Presidents Xi Jinping and Donald Trump agreeing to return to the table. The US has in good faith promised not to levy additional tariffs on Chinese goods before discussions resume. Our June Rare Earth Report focused on the Sino/US trade war which was arguably at the heart of the soaring rare earth prices and the flurry of renewed investor interest.

However, we do not expect the road to reconciliation to be an easy one. China has indicated that they wish for all tariffs to be canceled, and for Trump to end his hard-line approach to Huawei. Meanwhile, China’s NDRC relaxed restrictions against foreign investors across various sectors, though left its policies on foreigners separating rare earths unchanged- a clear indication that China intends to keep their rare earth sector as closed to foreign investors as possible.

This has sparked renewed efforts for countries to limit their reliance on Chinese material. The US Department of Defense (DoD) approached two African-based junior rare earth companies, Mkango, and Rainbow Rare Earths. The former, is still years away from coming online, while Rainbow, who is developing a project in Burundi, has been shipping concentrates since 2017, but already has an offtake agreement in place with ThyssenKrupp AG.

The US is a fairly late player with respect to securing rare earth offtake agreements and coming on board as a JV partner with rare earth prospectors. However, given the proportion of rare earths that the country consumes, and the propensity that the DoD has to stockpile rare earths, the US could well be perceived as a strong partner.

Efforts to secure supply within the US continue. Medallion has now joined Lynas and Mountain Pass in trying to help build a processing plant in the US with the aim of processing metals from monazite material. To date no timelines or costs have been provided so it is difficult to place too much weight on this latest revelation. Suffice to say that Mountain Pass is still sending its raw materials to China for processing and incurring higher tariffs. So if there would be a local solution that would be welcome.

The US is not alone in its concerns over rare earth supply. India is now toying with the idea of privatising its minerals sands. To curb illegal enterprise, government enacted a ban on mining private beach sand earlier this year, but now in the face of limited supply, government may revoke this legislation.

China meanwhile is said to be starting its new round of environmental inspections, but this time with no provision for emergency production. The Chinese government has indicated that this round will trump previous inspections in terms of its stringency and zero tolerance for non-compliant firms.

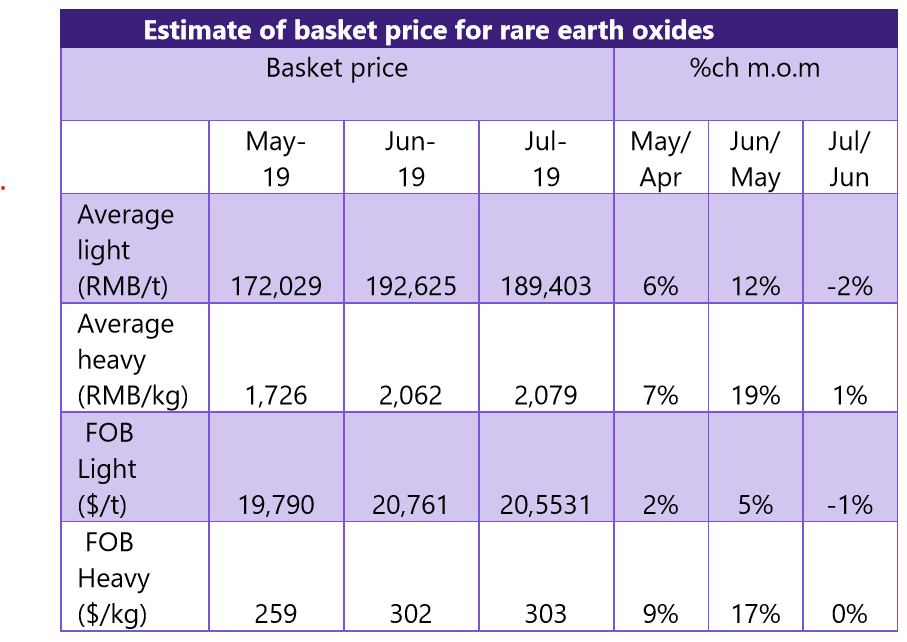

July and August are expected to be slower months, though we do not expect that the market will give back all its gains from June

Looking ahead, notwithstanding potential shutdowns for environmental reasons, we expect that July and August will be slower months, characterised by fewer transactions as the US and Europe reduce production during the summer months. Permanent magnet prices have also declined slightly, which has negatively impacted neodymium, praseodymium and Pr/Nd oxide prices, though we don’t expect the market will give back all its gains from June.

For the full picture on the rare-earth market, subscribe to our regular coverage today.