The global copper market is primed for a potential surge in prices, spurred by a convergence of factors that are boosting demand and shaking up supply dynamics. Copper, a critical element in industries ranging from construction to electric vehicles (EVs), is on the radar of investors and analysts alike. At the forefront of this excitement is Idaho Copper Corp, (OTC Pink: COPR), a U.S-based copper explorer advancing its flagship CuMo Project to capitalize on the shifting market dynamics by tapping into Idaho’s rich copper resources.

Copper prices on the rise

According to Fastmarkets, copper prices are expected to hit record highs in the fourth quarter of 2024, driven by several key trends. The U.S. Federal Reserve is expected to ease interest rates, while China has rolled out significant stimulus measures to revive its economy. These factors are set to provide a tailwind for the copper market, which has already seen steady demand growth as a result of its critical role in infrastructure, electrification, and renewable energy initiatives.

In October 2024, copper prices climbed to an average of $9,254.50 per metric ton, reflecting a 3.2% increase from the previous month. While prices have fluctuated throughout the year due to concerns about China’s stimulus effectiveness, the long-term outlook remains bullish. Saxo Bank recently noted that, despite short-term price declines, doubts over China’s stimulus measures are starting to dissipate as signs of recovery emerge. Copper, the metal at the core of this resurgence, is poised for a strong finish to 2024 and beyond.

Source: LME 3 Month Cash Settlement Price

Idaho Copper Corp (OTC: COPR) positioned for growth

As global copper prices continue to rise, Idaho Copper Corp’s CuMo Project is strategically positioned at the centre of Idaho’s burgeoning copper exploration industry. The state has quickly become a key hub for copper, making Idaho Copper Corp’s projects well-aligned with the increasing demand for domestically sourced critical materials in North America. With the U.S. placing a strong emphasis on securing local supplies of essential minerals, the company’s exploration efforts stand to benefit from both its advantageous location and the region’s growing importance in copper production.

In September 2024, Idaho Copper achieved a significant milestone with positive results from its MinesSense XRF testwork, confirming the amenability of its CuMo deposit to ore sorting. This result is crucial, as the technique allows the company to pre-sort ore before mining, ensuring that only higher-grade material enters the mill. By enhancing the ore feed quality, the company can reduce the required mill size compared to previous plans, leading to lower capital and operating costs.

Idaho Copper Corp’s commitment to environmentally responsible mining practices gives it an edge in a market increasingly focused on sustainable solutions. The company’s strategic plan aligns with growing demand from sectors such as renewable energy, where copper is essential for wiring, batteries, and other crucial components. Pending the necessary permits, Idaho Copper Corp aims to begin its CuMo drilling program as early as April 15, 2025.

Source: Idaho Copper Company Presentation, September 2024

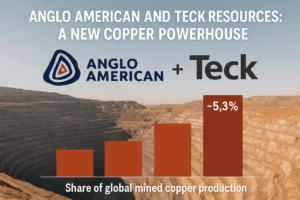

Supply chain challenges and recovery

Copper supply has grown, but challenges remain. The International Copper Study Group (ICSG) reports a 2% increase in global copper mine production in the first eight months of 2024. This modest growth was driven by recoveries in Chile and Indonesia, as well as strong output from the Democratic Republic of Congo (DRC). However, production in key markets like Peru and the U.S. has been constrained, with U.S. output falling by 5% during the same period.

Refined copper production grew by 5%, largely due to expansions in China and the DRC, which together account for 54% of global output. In contrast, Chile’s output fell by 7%, contributing to market supply constraints. Despite these fluctuations, there was a surplus of about 535,000 metric tons of copper in early 2024, indicating that global supply is currently meeting demand.

Source: FastMarkets, 11 October 2024

Source: FastMarkets, 11 October 2024

The electric vehicle (EV) revolution

Perhaps one of the biggest drivers of copper demand in the coming years is the electric vehicle (EV) sector. As EV production ramps up globally, the demand for copper – an essential material in EV batteries, motors, and charging infrastructure – is set to skyrocket. According to some estimates, the average EV contains around four times as much copper as a traditional gasoline-powered car. This surge in demand is expected to create substantial pressure on copper supply chains, especially in the U.S., where the Biden administration’s push for EV adoption is central to its climate agenda.

Idaho Copper Corp is keenly aware of this opportunity and is positioning itself to become a key supplier to the U.S. EV market. By focusing on domestic exploration and extraction, the company aims to reduce reliance on imports, and ensure that the U.S. has a stable, sustainable supply of copper for its burgeoning EV industry.

Exploring copper’s potential

The copper market is experiencing notable shifts, with rising demand, tightening supply, and supportive macroeconomic trends. For those interested in the U.S. copper sector, Idaho Copper Corp stands out as a company with promising exploration projects. As global copper demand is expected to outpace supply in the coming years, the company’s timing could align with future market growth.

Copper stocks held at major metal exchanges, such as the London Metal Exchange (LME) and COMEX, have risen by 134% since December 2023, reflecting a trend of increased stockpiling. This trend may suggest anticipation of future supply challenges, which could positively impact copper prices. As the market evolves, companies like Idaho Copper Corp (OTC: COPR) may find themselves well-positioned to navigate and capitalize on these developments.

A market on the cusp of transformation

The copper market is transforming, driven by the global push for electrification, renewable energy, and the expansion of critical infrastructure. With prices expected to hit new highs in late 2024, copper is once again at the centre of the commodities conversation. Idaho Copper Corp is uniquely positioned to capitalize on these trends, thanks to its strategic location, commitment to sustainable practices, and focus on meeting the growing demand for copper in North America.

As the world accelerates its shift towards a low-carbon future, the role of copper in enabling this transition cannot be overstated. For Idaho Copper Corp (OTC: COPR), the future looks bright, with the company poised to play a critical role in securing the copper supply needed to power the next generation of innovation in the U.S.