Global nickel resources are currently estimated at almost 300 million tonnes with more than two million tonnes of new or primary nickel produced and used annually. While more than 25 countries can claim nickel production, just five countries account for over 50% of total supply, namely: Australia, Indonesia, South Africa, Russia and Canada.

The overwhelming majority of nickel is employed in stainless steel production, which, until the end of 2019, was experiencing consistent rising demand of roughly 2-3% per year. The Indonesian government has for many years, starting in 2014, issued a ban on the export of nickel ore and other raw materials in response to rising demand, wanting to try and capture the downstream processing revenue and encourage beneficiation in the country. 2019 the country again saw fit to issue such a ban, this time aimed at nickel ore, with the aim of driving up prices and turning the country into a production hub for value-added nickel products.

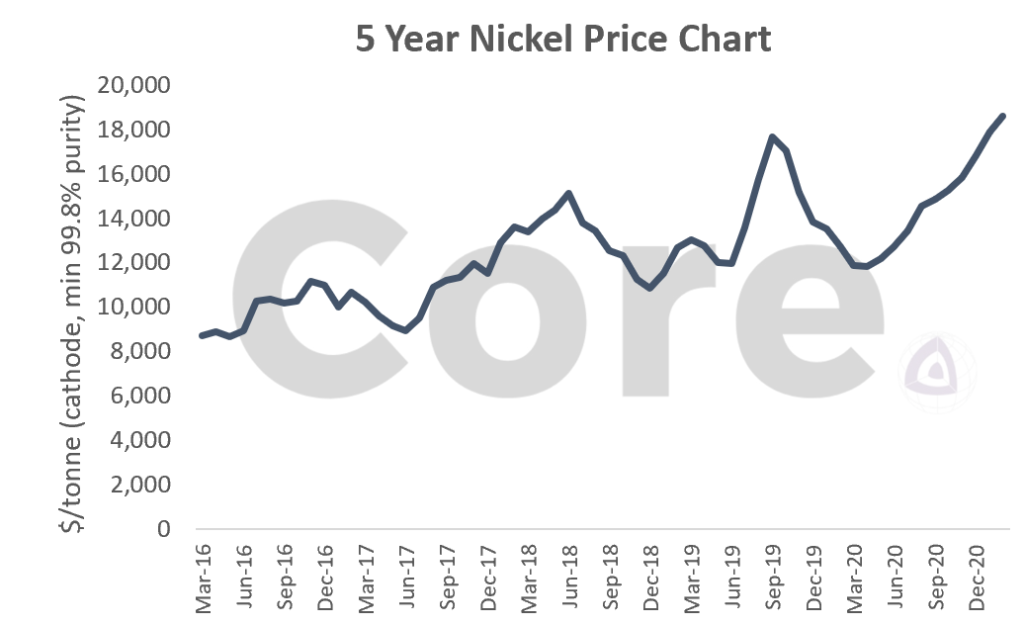

In response, fearing the move would hurt domestic nickel pig-iron (NPI) industries, Chinese manufacturers began stockpiling nickel. This move predictably sent prices rocketing and by September 2019, prices had moved up more than 60% from the start of the year to over US$16,000. When the Indonesian ban was officially introduced, nickel prices rose by a further 8.8% to reach a peak of US$18,620 per tonne – its highest point since 2014.

The COVID Effect

Cue COVID-19. Starting at 10 a.m. on 23 January 2020, Wuhan city officials prohibited all transport in and out of the city of 9 million residents, and within hours of the Wuhan lockdown, travel restrictions were also imposed on the nearby cities of Huanggang and Ezhou and were eventually introduced for all of the 15 other cities in Hubei, affecting a total of around 57 million people.

This brought about a dramatic curtailment of stainless-steel production, with year-on-year output in China falling by 12% in Q1 alone, causing the recent stockpiling efforts of local manufacturers to ramp-up total nickel stocks in the country by 50% in the first two months of 2020 to almost 3Mt.

For the first time since 2015, the market for primary nickel was in surplus. From a market deficit of 33,000 tones in 2019, the tables had turned and by the end of Q1 2020 the surplus reached 100,000 tonnes. In response, market participants revised their price forecasts downwards, bringing an abrupt, but surprisingly temporary end to that particular bull story.

The fact that the price fall was so short-lived has been attributed to the long term fundamentals for nickel. While analysts all agree that throughout 2020 the nickel market remained in surplus, a recovery in prices was seen from the end of 1Q2020. from April 2020 when the prices were at $11,192/tonne, we’ve seen a sharp and consistent rally with prices eventually hitting their peak of $19,568/tonne in February 2021.What this means is that the market fundamentals and prices had become so detached as participants had faith in the long term outlook for nickel. Nickel’s use in electric vehicle (EV) batteries, compounded by concerns over near-term supply shortages for battery-grade nickel products and their feedstocks saw prices move up strongly despite a surplus market.

A Second Black Swan

Historically, nickel sulfide has been technologically easier and therefore cheaper to process than laterite ore. However, for the last few years, the opposite has been true; a trend that is expected to continue but was largely ignored perhaps due to the associated environmental controversies of smelting low-grade laterite ores and seemingly unpredictable economics of the emerging processing technique.

A small number of companies had already employed high-pressure acid leaching (HPAL) to recover class-one nickel from lower-grade laterites, but many of these endeavours were abandoned due to environmental concerns and bad yields. However, as is commonplace in materials processing, manufacturers are driven to break down barriers to open up new market segments; where profit is concerned, no problem is insurmountable.

Fearing that HPAL would not come up with the goods, an increasing number of analysts began to speak about the risk of a future deficit in battery-grade nickel products. S&P Global took a cautionary tone regarding booming EV demand and the need for additional nickel sulfide deposits that could more readily produce nickel sulfate, the key ingredient for EV batteries.

While the overall automotive sales figures during 2020 were less than encouraging, this is a continuation of an ongoing trend away from vehicles that rely on internal combustion. During the same period, sales of battery electric and plug-in hybrids both surged, with plug-ins accounting for just over 1 in 10 of all cars sold in the UK last year, where sales of all non-zero emission cars will be banned by 2030, with the exception of certain hybrids.

Between 2015 & 2020, EV sales leapt from 450,000 to 2.1M, and by 2040, over half of all passenger vehicles sold are expected to be electric. Global lockdown measures to combat COVID-19 gave the global population a chance to experience a low-carbon world for the first time, and looming CO2 targets coupled with resultant government investment have led to record EV sales, with Europe overtaking China in 2020 as the largest EV market in the world.

Historically, nickel sulfide has been technologically easier and therefore cheaper to process than laterite ore. However, for the last few years, the opposite has been true; a trend that is expected to continue but was largely ignored perhaps due to the associated environmental controversies of smelting low-grade laterite ores and seemingly unpredictable economics of the emerging processing technique.

A small number of companies had already employed high-pressure acid leaching (HPAL) to recover class-one nickel from lower-grade laterites, but many of these endeavours were abandoned due to environmental concerns and bad yields. However, as is commonplace in materials processing, manufacturers are driven to break down barriers to open up new market segments; where profit is concerned, no problem is insurmountable.

This type of disruption is particularly well-known in emerging technology markets, and the lithium-ion battery market is no exception. In 2018, cobalt was the hot topic owing to global supply concerns and rising battery demand forecasts. This propelled the price to US$95,000 per tonne before it collapsed to less than US$30,000 per tonne just a year later.

To reduce dependence on the-now-prohibitively-expensive cobalt, manufacturers doubled down on efforts to usher in the dawn of a new battery cathode that would contain a third of the cobalt and almost double the nickel (the NCM-811 cathode).

These advancements were slated to reduce the cost of the end product and increase the share of global nickel demand from EVs from 4% in 2018 to 31% in 2040. Down goes the cobalt price; up goes nickel.

We shouldn’t be surprised then, that similar events transpired in 2021: Tsingshan, the world’s largest stainless-steel producer, announced in March that it would use the HPAL process to convert its NPI stocks into nickel matte and supply 100,000 tonnes within a year, starting from October 2021.

The company had already begun trial production of high-grade nickel matte (>75% Ni) from July 2020 at its sprawling facilities in the Indonesia Morowali Industrial Park. Tsingshan now claims that it can supply this feedstock on a regular basis, which can be converted directly into nickel sulfate by electrolysis.

The news that NPI stocks would be used to produce battery-grade nickel sent shockwaves through the market once more. The three-month LME nickel price declined by over 8.5% on the 4th of March to US$15,945 per tonne, bringing the axe down on 6-year highs achieved only a few weeks earlier.

Despite Tsingshan demonstrating the NPI to matte conversion process to be economically viable, the sustainability of this source of nickel production is still in question. Smelting of laterite ores to produce NPI is highly energy intensive (even without the additional acid-leach process). Furthermore, the reliance on coal burning as an energy source renders this particular nickel product as one of the highest CO2 emitters in the industry.

This presents western OEMs such as Tesla with a tough choice: pay extra for more efficient nickel production under tighter supply or grab the cheap and abundant stuff that comes with a carbon footprint of roughly four tonnes of CO2 per 50kg of nickel. On the one hand, the high cost of EVs is consistently cited as the most prohibitive factor by potential buyers, but on the other hand, lowering CO2 emissions is their primary purpose. Let us not forget that a large part of Tesla’s success and future growth is in its Chinese based battery gigafactory and the fact that it’s already taken pole position in the Chinese EV market – shipping 50,000 vehicles in the first half of 2020, accounting for 21% of the consumer EV market. If the largest producer and State Owned Enterprise (SOE), Tshingshan begins to produce nickel matte from NPI, Tesla may be forced to incorporate it in its supply chain in order to ensure continued good relations.

Take aways

This is a problem we will have to fully face in the not-so-distant future. Today, lithium-ion batteries account for only 7% of total nickel demand, and so stainless steel continues to be the dominant end use. The EV brigade has long been overly bullish about the impact of battery production, often citing that batteries will outpace stainless in overall nickel consumption.

The more bullish analysts hold the notion that consumption of nickel for lithium-ion batteries will outpace that of stainless steel within a few years. In 2018, nickel consumed by the EV market was estimated at 100,000 tonnes with many analysts forecasting that this figure will rise by five times by 2025. The more conservative and reasonable end-use forecasts, however, put stainless steel at a little over half of nickel consumption, and batteries just over a third by 2030.

Chinese NPI production costs range between US$3.50-$4.50 per lb, and it is estimated that making nickel matte could add an extra US$2 per lb. While the total sum is still less than the current nickel price, with NPI and matte both receiving approximately 85% of LME price in sales, the additional cost of making matte from NPI translates into an average LME price of US$7.60 per lb as a break-even cost for production.

Considering that the long-term consensus nickel price, according to data from CIBC, is US$16,228/t (US$8.11/lb), the question must be raised as to why NPI producers would increase costs simply to reduce profit, all while facing major emissions controversies. Without significant improvements, it seems more likely that HPAL for NPI is not yet a complete solution, and that the nickel market must still step-up class-one production if it is to meet projected battery demand.

If history is doomed to repeat itself, then what we have learned is that time and resources is all it will take to develop the process to such an extent that it becomes the primary method of production for high-grade nickel products.