Investors brace for impact

Copper is emerging as a crucial player, signalling a potential shortage with significant ramifications across industries. Recent shifts in sentiment among investors and analysts underscore growing concerns about the future supply of this essential metal.

Investor sentiment and market dynamics

Investors are re-evaluating their stance on copper, driven by apprehensions about future supply constraints and surging demand. Funds have adjusted positions on copper, moving away from bearish stances as macroeconomic uncertainties ease. Reports indicate a transition from net short to marginally net long positions on both the London Metal Exchange (LME) and CME contracts.

Supply-side challenges- mining giants revise output downward

Supply-side challenges are becoming evident, with notable developments highlighting potential constraints in the copper market. The closure of First Quantum’s Cobre Panama mine and downward revisions in production forecasts by major producers like Anglo American and Vale, emphasize the vulnerability of global copper supply.

In addition to a faltering supply pipeline, the copper industry faces structural hurdles in ramping up production to meet burgeoning demand, especially amid the global shift towards clean energy and electrification. Concerns about future copper supply adequacy have been raised at conferences like the World Copper Conference in Santiago, Chile, with analysts warning of a significant supply shortfall by 2031.

Investment strategies and uncertainties

Mining giants are stepping up efforts to increase copper production through acquisitions and investments, acknowledging copper’s crucial role in transitioning to a low-carbon economy. However, challenges like geopolitical risks and the lengthy lead times required to develop new mining projects complicate these investment strategies.

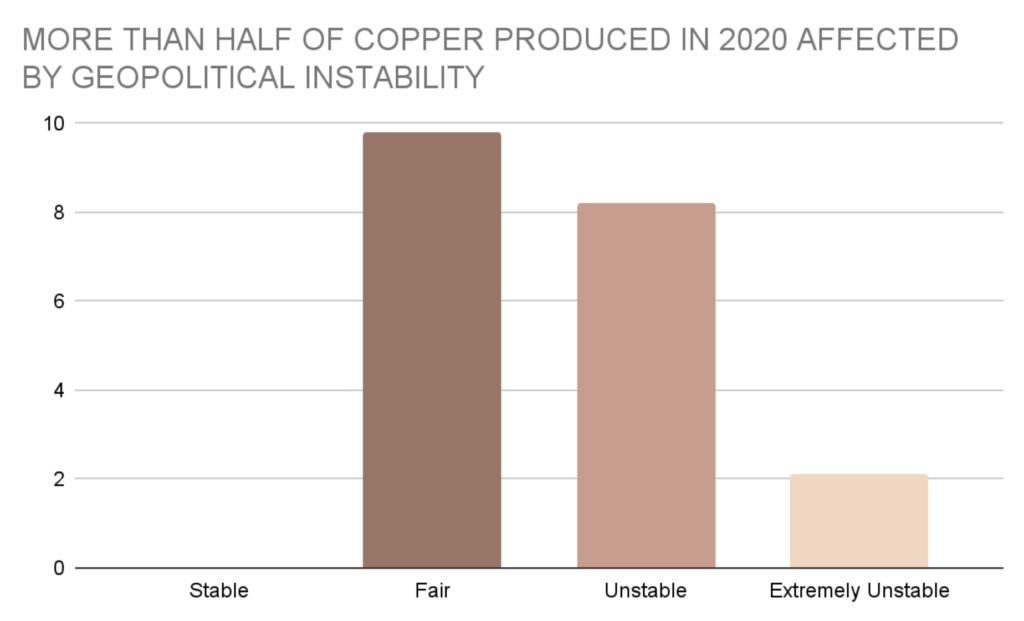

According to data collection agency, Statistica, in 2020 alone more than half of the global copper production was threatened by geopolitical instability as is depicted in the chart below.

Amidst these challenges, projects like CuMo owned by Idaho Copper (OTC: COPR) become significant in addressing supply pressures. Located in Boise, Idaho, with extensive measured and indicated resources, the project promises to meet the increasing demand for copper. Technological advancements, such as ore sorting, aim to boost efficiency and cut capital costs, potentially raising the project’s net present value.

As Idaho is known for its mining-friendly policies and abundant workforce, the Idaho Copper CuMo Project stands out as a beacon of hope in the copper market. With more than 4 billion pounds of copper, 1.6 billion pounds of molybdenum, and 180 million ounces of silver in measured and indicated resources, the project offers substantial promise in meeting the escalating demand for copper.

Technological advancements enhance efficiency for Idaho Copper (OTC: COPR)

The use of industry-proven ore sorting technology is expected to slash capital costs at CuMo, from over $3 billion (estimated in the 2020 Preliminary Economic Analysis) to a target of around $1 billion. These advancements herald a new era of cost-effective mining practices.

In an interview, Andrew Brodkey, the company’s COO, indicated that they expect the forthcoming updated preliminary economic analysis (“PEA”) to reveal a significant increase in the project’s net present value, where the base case was previously estimated at $356 million over a 30-year mine life (at an 8% discount rate). The company is on track to deliver the updated PEA in the second half of 2024, which should showcase the project’s enhanced value and offer investors renewed confidence in its prospects.

Navigating market uncertainties for copper supply

Despite the optimism surrounding projects like CuMo, investors remain cautious due to lingering uncertainties in the market. Geopolitical risks, supply chain disruptions, and fluctuating demand patterns continue to overshadow the copper industry, highlighting the importance of strategic foresight and resilience.

Charting the path forward

As the world moves towards a greener future, experts expect the demand for copper to soar, driven by electrification and renewable energy projects. Projects like Idaho Copper’s CuMo can provide a lifeline to meet this demand, with technological advancements and favorable regulatory environments contributing to the sustainable growth of the copper market.