As the global energy transition accelerates, copper — the metal at the core of electrification and renewable energy — has found itself in the spotlight. 2024 is expected to finish with a surplus copper market in the order of 800,000 metric tonnes, driven by record-high production. But beneath this apparent abundance lies a growing realization: this surplus might be fleeting, as industries from renewable energy to electric vehicles (EVs) gear up for exponential growth. This bodes well for copper-focused companies including Antofagasta plc (ANTO.L), Codelco, Southern Copper (NYSE: SCCO) and Idaho Copper (OTC: COPR).

Renewables driving the surge in copper demand

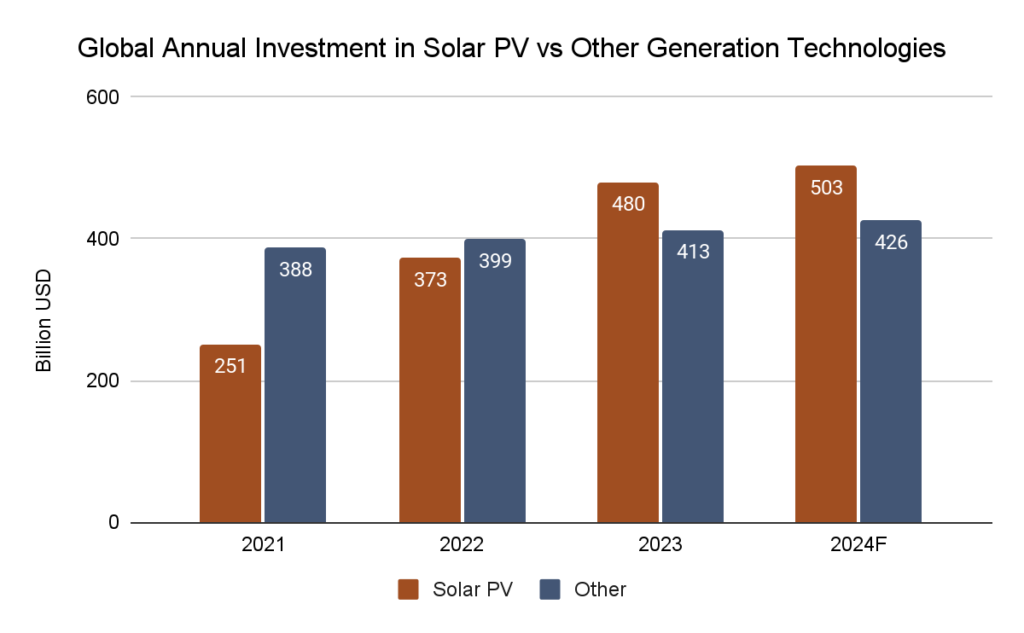

The renewable energy sector is a key driver of copper consumption. Copper’s exceptional conductivity makes it essential for solar panels, wind turbines, and the intricate electrical networks that power them. China, the world’s largest solar market, is on track to add 566 GW of solar capacity, requiring a staggering 3.1 million tonnes of copper.

Wind energy tells a similar story. A single onshore wind turbine can consume 4.7 tonnes of copper, while offshore turbines, due to their increased complexity, demand even more. In the United States, wind generation is set to rise by 16% in 2024, with nearly 117 GW of new capacity planned — translating to over 184,000 tonnes of copper demand.

The U.S. solar industry is also expanding rapidly, with a projected 20% increase in power generation in 2024 and 50 GW of additional capacity expected by 2030. This expansion underscores the critical role of copper in achieving a cleaner energy future.

Source: SolarPower Europe 2024, IEA 2024

EVs: Supercharging copper usage

Copper’s role in the transportation sector is equally transformative. Electric vehicles use nearly four times as much copper as traditional internal combustion engine vehicles. From motor windings to charging infrastructure, copper is indispensable to the EV ecosystem.

The numbers speak volumes. In the U.S., EV sales surged to account for nearly 25% of total vehicle sales in the second quarter of 2024. China, the global leader in EV production, manufactured over 8.3 million EVs in the first nine months of the year alone. With the U.S. poised to triple its EV manufacturing capacity by 2028, the demand for copper in this sector is set to soar.

Copper market supply-side challenges loom

Despite increasing demand, the copper supply chain faces significant challenges. Bringing new copper mines online takes an average of 17 to 20 years, hindered by environmental permitting, community resistance, and declining ore grades. For example, Chile, the world’s largest copper producer, has seen ore grades decline by 30% over the past 15 years, further straining production capacity.

Several high-profile projects have faced significant delays. The Resolution Copper project in Arizona, which holds over 27 million tonnes of copper, has been stalled for 27 years due to local opposition and regulatory hurdles. Similar challenges face other projects worldwide, underscoring the difficulty of ramping up copper supply quickly enough to meet demand.

Idaho Copper: A domestic solution to a global challenge

Amid these supply chain constraints, companies like Idaho Copper (OTC Pink:COPR) are emerging as critical players in addressing future copper shortages. Idaho Copper is advancing the CuMo project, one of North America’s largest undeveloped copper resources. This project also features valuable co-products, including molybdenum and silver, making it a multi-faceted solution to the increasing demand for critical metals.

According to Idaho Copper’s latest investor meeting, the company is progressing toward a 2030–2031 production start date. CEO, Andrew Brodkey, highlighted plans to raise $40 million to complete a pre-feasibility study and fund necessary drilling and fieldwork during 2025. Additionally, the company is actively exploring grant opportunities from the U.S. Department of Defense and Department of Energy, further positioning itself as a strategic domestic supplier of copper.

Idaho Copper’s approach underscores a broader push for regionalized, sustainable supply chains. With the U.S. seeking to reduce reliance on foreign sources for critical materials, projects like CuMo could play a pivotal role in shaping the future of the copper market.

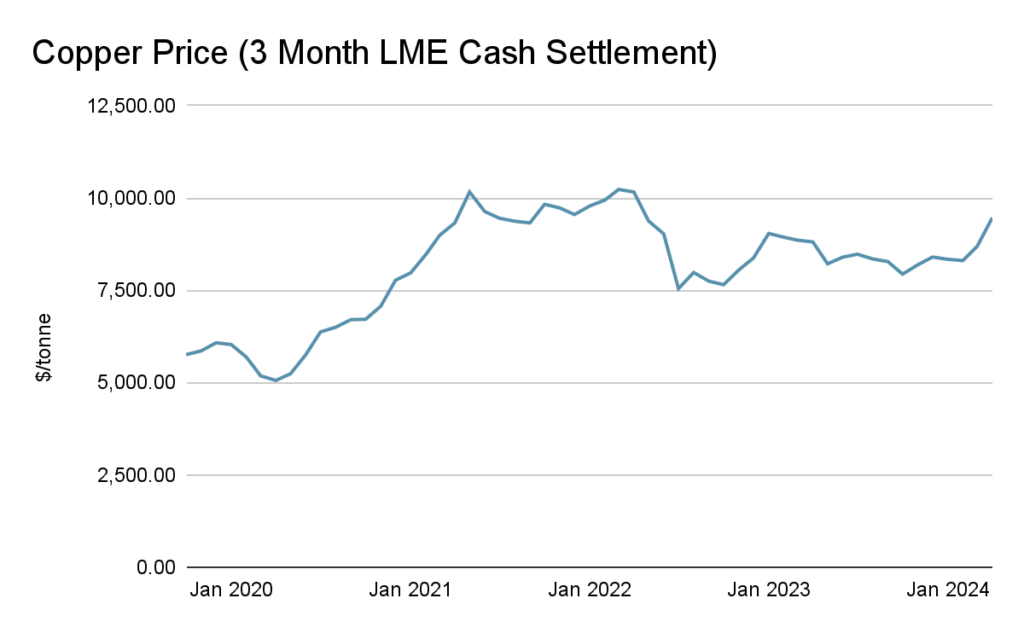

Pricing trends reflect tightening copper market

Copper prices have already begun to reflect growing demand pressures. In 2024, the average price reached $4.38 per pound, up from $4.02 in 2023. Exchange warehouse stocks, which doubled to 367,000 tonnes, remain insufficient to meet anticipated future needs.

Beyond traditional industries, emerging technologies are adding to copper’s allure. Data centers, for instance, are projected to require nearly 2.9 million tonnes of copper between 2024 and 2030, further tightening the market.

Source: Index Mundi, LME Copper Price

Why investors should care

For industries and investors, the message is clear: today’s copper surplus is a temporary phenomenon. With renewable energy, EVs, and infrastructure development ramping up, demand is set to outstrip supply in the coming years. Companies like Idaho Copper are uniquely positioned to capitalize on this shift, offering a domestic solution to a global challenge.

As the market transitions, those who act early to secure supply or invest in strategic players stand to gain the most. For businesses and investors alike, the time to engage with the copper market is now — before the surplus becomes a shortage.