Alphamin Resources

TSX.V : AFM | JSE Altx : APH

Alphamin Resources is a low cost tin concentrate producer from its high grade deposit at Mpama North. At a tin grade of roughly 4.5%, Mpama North is the world’s highest-grade tin resource – about four times higher than most other operating tin mines in the world.

Alphamin Resources

Alphamin Resources is a low cost tin concentrate producer from its high grade deposit at Mpama North. At a tin grade of roughly 4.5%, Mpama North is the world’s highest-grade tin resource – about four times higher than most other operating tin mines in the world.

Sign up to get your FREE

Idaho Copper Corp. Investor Kit

and hear about exciting investment opportunities

This Alphamin Resources profile is part of a paid investor education campaign*

Core Consultants’ features on

Alphamin Resources

Copper market surplus: Why it could be short-lived

As the global energy transition accelerates, copper — the metal at the core of electrification and renewable energy — has found itself in the spotlight. 2024 is expected to finish

Idaho Copper Corp positioned for leading role in growing U.S. copper market

The global copper market is primed for a potential surge in prices, spurred by a convergence of factors that are boosting demand and shaking up supply dynamics. Copper, a critical

Copper: The backbone of the renewable energy transition

Idaho Copper (OTC Pink: COPR), a US-based copper development company, is at the center of helping the United States realize its climate and energy goals. The growing demand for copper

The copper market outlook amid potential political shifts

Amid the backdrop of a US election year, the copper market is poised for significant shifts. A change in political power could spell a bright future for US-based copper development

The strategic importance of copper in military defense

The significance of copper in the defense sector has become increasingly evident. This essential metal, a cornerstone of military technology, is crucial for maintaining the efficacy of existing defense systems

Copper market outlook: A surge in demand and the strategic role of US deposits

Rising prices and economic indicators In a recent comment about the copper market, Idaho Copper Corporation’s (OTC: COPR) CFO, Robert Scannell pointed out that “BHP’s recent bid for Anglo American

Alphamin’s Bisie: a mine with an impact

Alphamin’s Bisie tin project in the Democratic Republic of the Congo (DRC) not only counts among the top five tin operations in the world, but the mines’ impact in the

Alphamin prepares for surge in tin demand

With the energy transition set to kickstart the lethargic global economy next year, tin producer Alphamin Resources Corp’s (AFM:TSXV, APH:JSE AltX) will be more than happy to deal with an

Alphamin now a world class sustainable tin producer

Alphamin Resources Corp’s (AFM:TSXV, APH:JSE AltX) exceeded all expectations in 2022 amidst global turmoil and regardless of a highly unpredictable market.

Alphamin Resources (TSX.V: AFM) bullish on outlook

Unmoved by current macroeconomics and with an expected deficit in the tin market looming over the next five years, Alphamin Resources Corp. (AFM: TSXV, APH:JSE Altx) is on course to

Alphamin’s super grades overshoot global norms

Alphamin Resources’ (AFM: TSXV, APH:JSE AltX) high grade tin at Bisie continues to be a matchwinner amidst a revival of low-grade brownfield projects around the world.

Alphamin’s consistency pays dividends

Alphamin Resources’ (AFM: TSXV, APH: JSE AltX) decision to expand its Bisie complex in the DRC in a bid to create further value for its shareholders, rather than to dispose

Sign up to get your FREE

Idaho Copper Corp. Investor Kit

and hear about exciting investment opportunities

*Disclaimer: This profile is sponsored by Alphamin Resources (TSX.V:AFM | JSE Altx : APH). This profile provides information which was sourced by Core Consultants Pty Ltd (“Core Group”) and approved by Alphamin Resources in order to help investors learn more about the company. Alphamin Resources is a client of Core Consultants and its subsidiary, PR | Re:public. The company’s campaign fees pay for Core Consultants to create and update this profile.

Neither Core Consultants, nor PR | Re:public, provides investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. Neither Core Consultants, nor PR | Re:public endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Alphamin Resources and seek advice from a qualified investment advisor.

Core Consultants’ features on Alphamin Resources

Alphamin’s Bisie: a mine with an impact

Alphamin’s Bisie tin project in the Democratic Republic of the Congo (DRC) not only counts among the top five tin operations in the world, but the mines’ impact in the

Alphamin prepares for surge in tin demand

With the energy transition set to kickstart the lethargic global economy next year, tin producer Alphamin Resources Corp’s (AFM:TSXV, APH:JSE AltX) will be more than happy to deal with an

Alphamin now a world class sustainable tin producer

Alphamin Resources Corp’s (AFM:TSXV, APH:JSE AltX) exceeded all expectations in 2022 amidst global turmoil and regardless of a highly unpredictable market.

Alphamin Resources (TSX.V: AFM) bullish on outlook

Unmoved by current macroeconomics and with an expected deficit in the tin market looming over the next five years, Alphamin Resources Corp. (AFM: TSXV, APH:JSE Altx) is on course to

Alphamin’s super grades overshoot global norms

Alphamin Resources’ (AFM: TSXV, APH:JSE AltX) high grade tin at Bisie continues to be a matchwinner amidst a revival of low-grade brownfield projects around the world.

Alphamin’s consistency pays dividends

Alphamin Resources’ (AFM: TSXV, APH: JSE AltX) decision to expand its Bisie complex in the DRC in a bid to create further value for its shareholders, rather than to dispose

*Disclaimer: This profile is sponsored by Alphamin Resources (TSXV : AFM | JSE Altx : APH). This profile provides information which was sourced by Core Consultants Pty Ltd (“Core Group”) and approved by Alphamin Resources in order to help investors learn more about the company. Alphamin Resources is a client of Core Consultants and its subsidiary, PR | Re:public. The company’s campaign fees pay for Core Consultants to create and update this profile.

Neither Core Consultants, nor PR | Re:public, provides investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. Neither Core Consultants, nor PR | Re:public endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Alphamin Resources and seek advice from a qualified investment advisor.

Highest grade tin mine in the world.

Low cost production.

ESG-conscious company.

Project: Bisie Tin Mine

Company Exposure: Tin

Project Location: Mpama North, DRC

Core Consultants' features on Alphamin Resources

Alphamin’s Mpama South expected to produce by 2023

One miners’ loss is another miners’ gain

Alphamin on a clear growth path

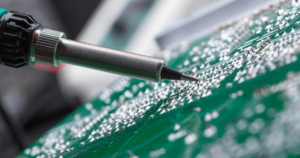

Tin keeps soldering on

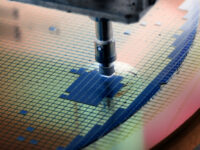

Alphamin’s tin complex central to the fourth industrial revolution

China market action benefits DRC mining

Can tin hit $50k?