Celsius Resources (ASX: CLA) recently released an exploration update for its Opuwo Cobalt Exploration Project. We concur with management, are happy with these results and look forward to the release of Celsius’ scoping study in the fourth quarter.

Unlike primary gold projects, which have been mined for centuries and are well-understood among investors, cobalt has always been a niche metal, mined as a by-product of copper and nickel typically by established mining companies. By contrast, the rise of the junior cobalt producer is relatively recent, and as such, investors tend to have less experience reading these drill results.

Regardless of the commodity, interpreting geological data is both a science and an art; though I prefer to think of it as part science, part experience. As such the aim of this article is to provide a high-level explanation of how we at Core Consultants crunch the numbers of a junior cobalt miner using Celsius Resources’ latest drill results as an example.

1. Sources of Cobalt Deposits

According the USGS, cobalt is typically found as a by-product in terrestrial and ocean floor deposits. In terrestrial deposits, cobalt is associated with nickel in sulphide minerals, which comprises around half of the world’s known resources. In seafloor deposits, cobalt is concentrated as hydroxide and oxide minerals with iron and manganese. With respect to terrestrial occurrences, there are four main deposits, namely:

- Sediment Hosted Deposits: Typically associated with copper with cobalt as a by-product, such as with reserves in Africa’s Copperbelt that spans the Democratic Republic of the Congo (DRC) and the North West of Zambia. Celsius Resource fits into this category, but is unique in that cobalt is the primary metal with a copper credit.

- Magmatic Mineral Deposits: Mainly exploited for nickel, copper and platinum group metals (PGMs) and found in Russia and Canada.

- Laterite Deposits: Primarily exploited for nickel, such as those found in Cuba and New Caledonia.

- Hydrothermal Deposits: Primary cobalt deposits and quite rare, such as those at Bou Azzar in Morocco.

Most deposits are of the sediment hosted variety, nickel laterite ores account for 36% of resources and magnetic sulphide deposits account for 15%.

[visualizer id=”5947″]

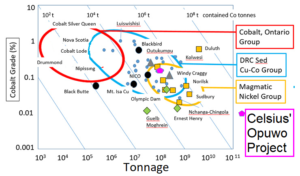

1.1 Grade vs. Contained Cobalt

Contained cobalt content and concentration fall within discrete ranges according to the deposit type. In general, cobalt deposits are either high-grade but lower in contained cobalt, or vice versa.

In Ontario, deposits are higher-grade but typically have low levels of contained cobalt plus deleterious elements. In general, a high presence of deleterious elements such as arsenic or cadmium means that the cost of production is higher as one must purify the concentrate. As such, deposits such as the Opuwo project is at an advantage as it has none of these nasty elements to content with.

Along Africa’s Copperbelt, the range of grades is quite diverse, but these deposits typically contain large tonnages of contained copper and cobalt. Looking at the Opuwo project, with grades of 0.11% cobalt and resources of 112.4 million tonnes, the project fares quite favourably against projects already in production.

2. Understanding Depths and Intercepts

Assuming mineralisation occurs near surface, and the ore zone is large enough to be mined in bulk, then mine plans today allow for large scale open-pit extraction. 200-tonne mining trucks capable of hauling large volumes of rock are used to allow the processing of vast tonnages of ore at a relatively low cost.

Open pits are generally less than 300 metres deep and a few hundred metres in diameter. As such, there are two main questions to consider when analyzing drill results, namely:

- How deep is the mineralization? (Best under 300m)

- How thick is the drill intercept?

If a company is drilling straight down, an intercept of over 100m thick is best, although the majority of mines do not attain this, and many remain economically feasible.

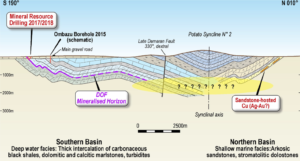

In the case of Celsius Resources’ Opuwo project, one must consider the relationship between the mineralization widths and the intercept lengths. In this case, the mineralized horizon is dipping as can be seen by the pink line in Figure 2 below, so the company chose to drill inclined holes at 55 degrees in order to approximate the true width. As such, the total length from the surface is less than the length of the hole.

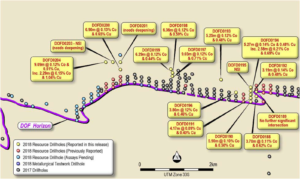

The Company is also improving its understanding of both the geology and its geometry of the formation by drilling at relatively close intervals of below 10m (Figure 3). It is important to consider the length of the the intercept as well as the distances between those intercepts that show consistent mineralisation.

The table below is a sample of Celsius’ drill results. We note that in each case, there is mineralization below depths of 300m, which is great. We also note that the mineralization tends to get higher the deeper one drills, which is to be expected given the dip we saw in Figure 2. Looking at the intercept intervals, we note that there seems to be continuous mineralogy along the intervals, and the grades are relatively constant if one had to plot them.

What is noteworthy about these results is the there is a definite trend towards a thicker mineralized zone and higher copper grades than was previously thought. This is even evident in drill holes located up to 750m away from the outcrop and outside the existing mineral resource (See Appendix tables of the announcement).

[visualizer id=”5956″]

3. Understanding Grades

We’ve established that the Opuwo project does have mineralization at shallow depths, but also that mineralization seems to improve as Celsius drills a bit deeper. As a rule of thumb, open-pit mining is cheaper than underground, but this is not always the case. In this instance, whether to mine the surface or underground rests on factors other than just grades and depth of mineralisation.

Some pertinent factors to consider include; the fact that the grades improve with depth, which may be a case for underground mining, the strip ratio (which refers to the amount of rock one would have to dig out before getting some of the valuable ore), and dilution factors must be considered. Dilution tends to be more apparent in the open pit scenario, but this will have to wait until Celsius releases its scoping study and mine plan in 4Q18.

Meanwhile, to understand these grades: for the sake of argument, say one is mining at $20/tonne. Consider then that 1% of a metric tonne is 22 pounds. Celsius has 0.11% cobalt mineralization, so 2.42 pounds for every tonne of rock mined. Now with cobalt fetching $25/lb, the contained metal is worth $60.5/tonne, yielding a cash or “on mine” profit of $40.5/tonne of ore.

Moreover, in the case of the Opuwo project, there are significant copper and zinc credits that offset the price of cobalt required to make the mine profitable. The latest results show slightly higher copper grades than what was stated in the Company’s maiden resource statement.

Happily, the price of cobalt is expected to remain elevated for the time being, copper prices are still above $2.7/lb while zinc has been hitting ten-year highs, rallying since 2016. Finally, the Opuwo project is the largest cobalt sulphide project outside of the DRC with over 112.4m tonnes of contained resource, so given the specific context, we believe that these drill results should be read favourably.

4.Next Steps

In order to ensure an efficient mine plan is developed, exploration companies must improve the accuracy of their drill results and further enhance understanding of the mineralogy as far as possible.

To this end, Celsius will now undertake to reduce the spacing of the drilling at the prospect and progress the deposit to higher confidence categories of mineral resources. Extensional drilling will also be undertaken with the aim of increasing the size of the mineral resource.

Celsius is also continuing its exploration on other parts of the Project to comprise geophysical surveys and surface sampling to define targets for further drilling.

Celsius Resources’ Scoping Study and updated Mineral Resource Report planned for 4Q18

Disclaimer: Celsius Resources is one of Core Consultants’ Public Relations Clients. Nothing in this article should be considered investment advice.

To find out more about Celsius Resources or if you are interested in purchasing shares in Celsius, please email lara@coreconsultants.org who will provide the appropriate contact person within the Celsius Resources Group.

To find out more about Core Consultants’ Public Relations’ Services, please fill out this form