Rising prices and economic indicators

In a recent comment about the copper market, Idaho Copper Corporation’s (OTC: COPR) CFO, Robert Scannell pointed out that “BHP’s recent bid for Anglo American PLC is a signal that the biggest players in the mining world are positioning themselves for a different world, where copper plays a starring role in the green economy.”

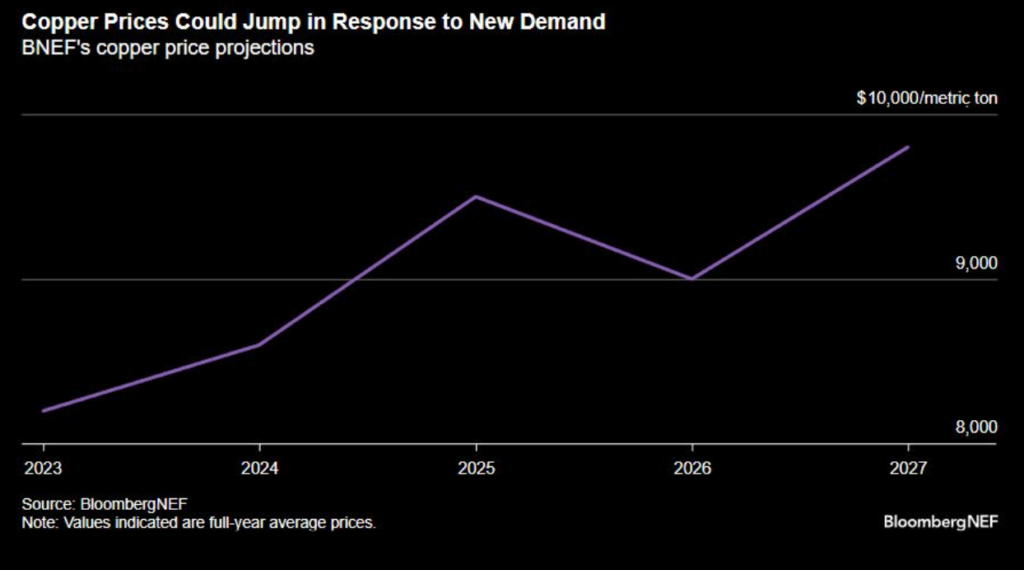

Indeed, recent trends in the copper market have highlighted significant growth in demand and rising prices, positioning copper as a critical element in the global economic landscape. As of April 2024, copper prices have moved to reflect this new reality, reaching $4.323 per pound in New York, marking the highest level since June 2022. This surge is primarily fueled by the metal’s essential role in the energy transition, particularly in manufacturing electric vehicles, power grids, and wind turbines. Analysts from major financial institutions predict a continued bullish trend, with potential prices reaching as high as $15,000 per metric ton in upcoming years under certain economic recovery scenarios.

Supply challenges and technological innovations highlight the strategic importance of US copper deposits

The global copper market is currently experiencing a tight supply situation, exacerbated by limited new mining operations and geopolitical tensions in key copper-producing regions like South America. In response, technological innovations, such as improved leaching techniques, are becoming increasingly important. These advancements could enable more efficient extraction of copper from low-grade ores, potentially revolutionizing the industry and mitigating some of the current supply shortages.

Amid these market dynamics, the United States holds a pivotal position due to its substantial and largely untapped copper resources. One of the most significant among these is the CuMo Project owned by Idaho Copper Corporation near Boise Idaho, which represents a large copper deposit yet to be fully explored and exploited. This deposit is crucial not only for its potential to alleviate some of the supply constraints, but also for its strategic importance in the U.S. market, which is seeing a resurgence in manufacturing and infrastructure development.

Idaho Copper Corporation: A game changer?

The role of Idaho Copper Corporation could be transformative for the copper market. Idaho Copper’s CuMo Project currently consists of 126 federal unpatented lode mining claims and 6 patented mining claims. In total, the project comprises approximately 2,640 acres.

As a large holder of copper resources in the U.S., it is positioned to contribute significantly to both national and global supply. Exploiting this deposit could help meet the burgeoning demand from various sectors, particularly those involved in renewable energy and electrification technologies. Furthermore, the development of this resource could stimulate local economies through job creation and infrastructure development, aligning with broader economic recovery and growth strategies.

In April, Idaho Copper revealed that it had commenced its XRF scanning of over 60,000 feet of drill cores. The data will be used to confirm the previous laboratory analysis of the metal distribution within the core which can then be used to determine potential ore sorting parameters.

When used correctly, ore sorting enhances the ore grade by sorting large volumes of ore based on their mineral content. This technology can greatly improve the efficiency and effectiveness of mining operations by eliminating waste and lower-grade ore early in the process and focusing energy and resources on processing the most valuable material.

The results obtained from Idaho Copper’s potential ore sorting parameters will be used to update the Company’s Preliminary Economic Assessment (PEA), which is targeted to be published by the end of 2024.

Future prospects and economic impact

Looking forward, the demand for copper is expected to continue its upward trajectory, driven by the global push towards green energy solutions and technological advancements. The U.S., with its strategic deposits such as those managed by Idaho Copper Corporation and others, plays a crucial role in this scenario. Not only could these resources help stabilize the copper market, but they also represent a significant investment opportunity that could yield returns for decades to come.

Copper looks poised for a long-term bull run

In conclusion, the copper market is at a pivotal point, with high demand and rising prices signaling the start of what may be a long-term bullish trend. The strategic importance of U.S. copper deposits, especially those like the CuMo Project of Idaho Copper Corporation (OTC: COPR) in Idaho, cannot be overstated. These deposits not only hold the key to resolving some of the supply constraints but also offer a beacon for economic growth and technological innovation in the copper industry. As such, they warrant significant attention from investors, policymakers, and industry stakeholders aiming to capitalize on the ongoing global shifts towards a more electrified and sustainable future.