Unveiling Alphamin’s success in a shifting tin landscape

A transition material unveiled

Tin, historically used in tools and bronze alloys, has evolved into a cornerstone of modern technologies. Its applications in semiconductors, solar panels, 5G technologies, and electric vehicles, position tin as a vital component driving robust demand in the modern era. While often overlooked, its recyclability aids the shift to circular models, aligning with the push for a net-zero, nature-positive economy.

Understanding tin demand drivers

The demand for tin is multifaceted, covering everything from corrosion-resistant coatings in metal packaging to vital solder in circuit boards. The growing adoption of EVs, renewable energy, and robotics is propelling demand, contributing to a projected global growth ranging from 1.1% to 2.8% per annum. Notably, tin’s role in semiconductors, 5G technologies, and consumer electronics highlights its significance in the ongoing technological revolution.

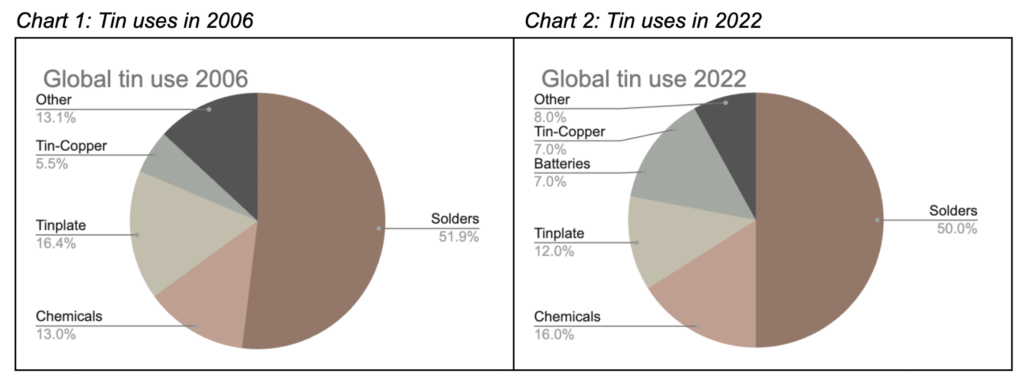

It‘s noteworthy that in 2006, “batteries” was not even a category for tin uses, and now it constitutes 7% of end-user demand. Source: ITA

Navigating substitution risks and market dynamics

While tin faces some substitution risks in specific applications, such as tinplate coatings and lithium-ion batteries, its unique characteristics and performance advantages mitigate these challenges. Substitution risks are low in specialty chemicals, contributing to a positive outlook for tin. Despite playing a critical role in the technology revolution, many often underestimate tin’s demand potential, undervaluing the material.

Supply sources and Alphamin’s triumph in tin production

Primary sources of tin, mainly mined, are limited, with few new projects in the pipeline. Key tin-producing countries include China, Indonesia, Myanmar, and Peru. Alphamin Resources, a prominent Canadian tin producer, emerges as a standout player, achieving a record production of 12,568 tonnes in 2023, up 1% from the previous year. Since beginning production in January 2019, Alphamin has thrived, paying off debt, boosting output, and growing its resource base.

Strategic initiatives: Mpama South expansion project

Positioned as a major contributor to the global tin market, Alphamin’s success is rooted in its high-grade Mpama North mine in the Democratic Republic of Congo. The company currently produces 4% of the global tin supply and is a key player in this critical industry. The Mpama North mine has been pivotal in establishing Alphamin as a major tin producer globally. The company is now actively pursuing the Mpama South expansion project, a strategic move expected to boost annual tin production by an impressive 60% upon commencement.

Challenges and financial resilience

Despite the positive outlook, Alphamin faced logistical challenges that delayed the start of processing at Mpama South to the end of March 2024. The capital expenditure cost for steady-state production at Mpama South is expected to exceed the budget by approximately 10%, primarily due to delays and minor scope changes. However, Alphamin’s financial resilience comes to the forefront as the company secured a four-year extension to its existing offtake agreement with the Gerald Group. This extension, with a substantial reduction in tin marketing costs and a tin prepayment arrangement of up to $50 million, positions Alphamin for continued growth.

Looking ahead, Alphamin projects a contained tin production ranging between 17,000 and 18,000 tonnes for 2024, up from 12,568 tonnes in 2023. The increase is due to the commissioning of Mpama South.

Market dynamics and challenges

Beyond Alphamin’s success, the global tin market is undergoing significant shifts. Challenges such as declining Myanmar artisanal production and an impending export ban on Indonesian tin in 2024, contribute to the tightening of the refined tin market. These challenges, while posing obstacles, also present opportunities for proactive industry players.

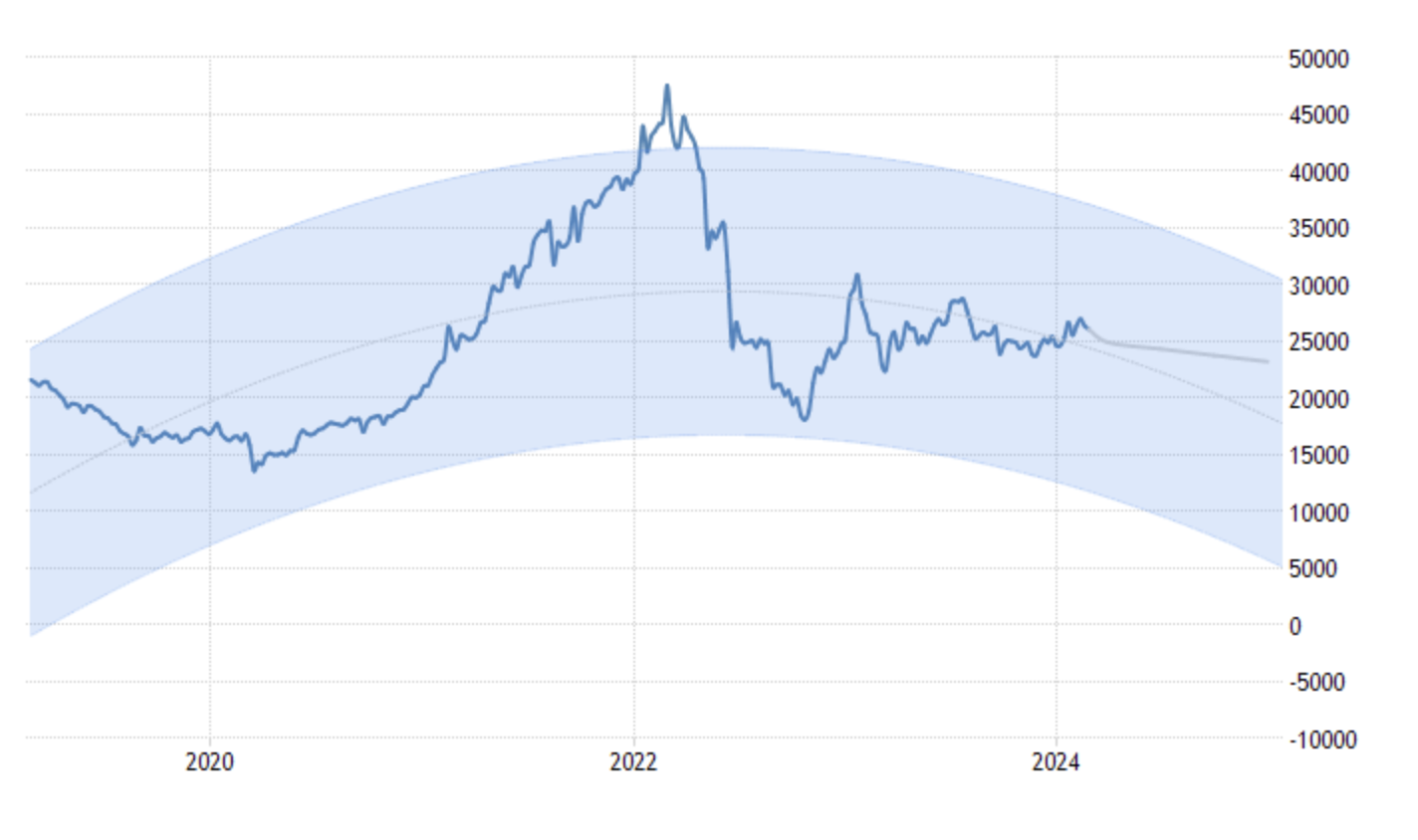

Leading international pricing agency, FastMarkets, forecasts a balanced global tin market in 2024, with the London Metal Exchange (LME) cash price averaging around $27,040 per tonne. Tin’s critical role in the technology revolution, particularly in semiconductors, solar panels, 5G technologies, and electric vehicles, positions it as a hidden beneficiary in the broader landscape of technological advancements.

Chart 3: Tin price forecast

Tin Prices are expected to remain robust in 2024, Source: Trading Economics

Investment opportunities in the tin market

Investors keen on exploring opportunities in the tin market have a range of options to consider. Alphamin Resources Corp. (TSXV: AFM | JSE AltX: APH) stands out as a notable player, alongside industry giants like BHP Group Limited (NYSE: BHP), PT TIMAH Tbk (OTC: PTTMF), Rio Tinto Group (NYSE: RIO), and Freeport-McMoRan, Inc. (NYSE: FCX). These companies, operating in diverse geographical locations, present investors with a variety of investment choices in the dynamic tin market.

In terms of its stock performance, Alphamin’s share has remained above C$0.91 per share resulting in a market capitalization of C$1.1 billion ($820 million) in 2023. Looking at the last five years, the Company’s share price has risen from C$0.25 per share to C$0.93 per share, providing outsized returns to investors.

Conclusion: Alphamin’s impact on tin’s future

In conclusion, Alphamin Resources’ (TSXV: AFM | JSE AltX: APH) achievements in 2023, coupled with its strategic initiatives and financial resilience, position the company as a significant contributor to the global tin market. As Alphamin navigates challenges and embraces new opportunities, its role in shaping the industry’s future is undoubtedly one to watch.